[PRESS RELEASE – Singapore, Singapore, October 28th, 2025]

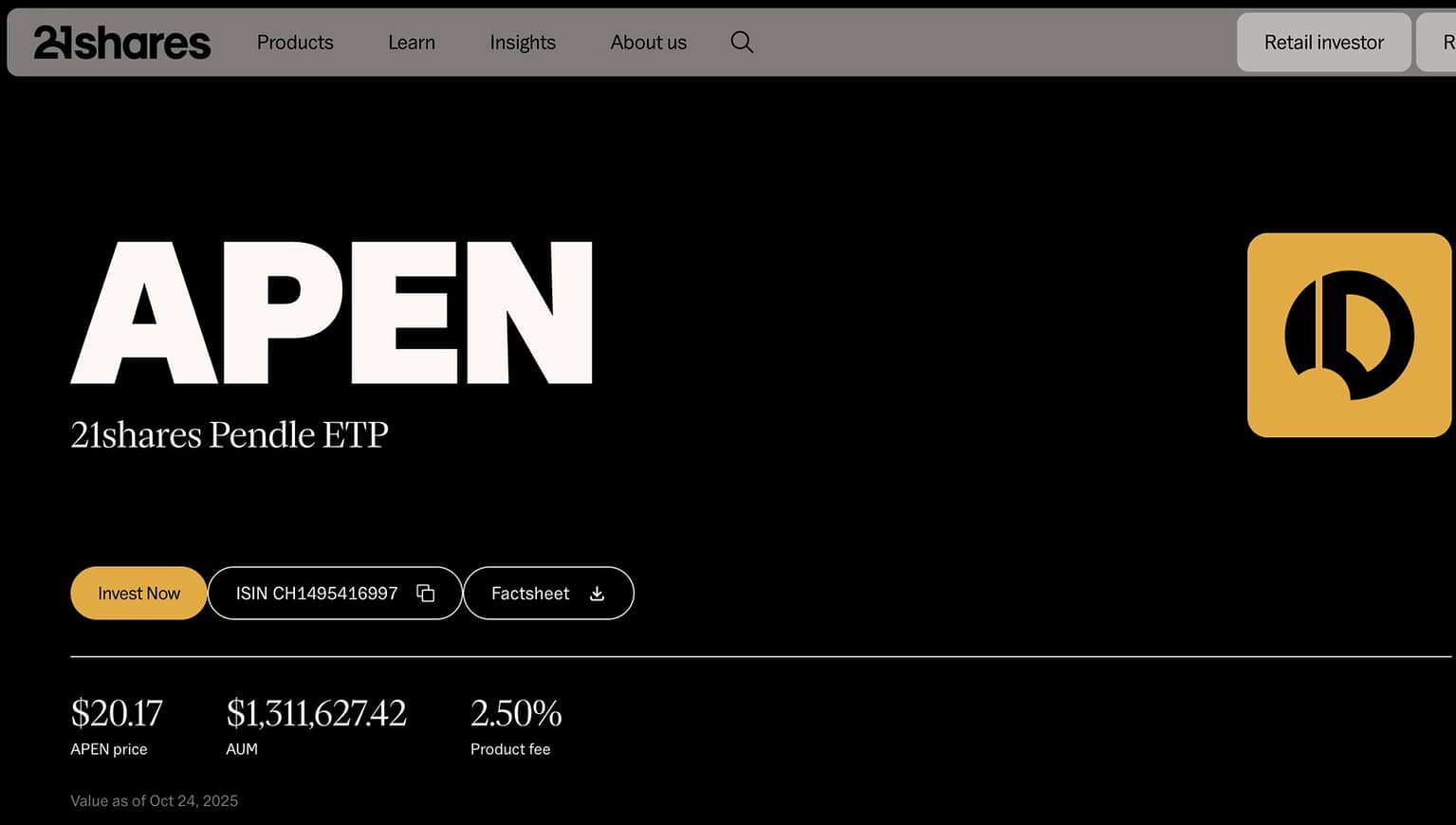

Asset supervisor 21Shares has launched an exchange-traded product (ETP) referred to as APEN based mostly on Pendle — a growth that alerts deepening institutional recognition of Pendle’s function in bridging conventional fixed-income markets with Decentralized Finance (DeFi).

One of the vital notable metrics underlining Pendle’s traction is its latest achievement: the protocol has settled $70 billion in yield, successfully making a bridge between the roughly $140 trillion world fixed-income market and crypto-native infrastructure. This milestone is supported by on-chain market conduct that sees Pendle’s method as an rising hyperlink between conventional finance and decentralized methods.

One other indicator of Pendle’s traction is its newest product referred to as Boros, designed for buying and selling funding charges from numerous centralized and decentralized exchanges in a DeFi-native atmosphere. Boros lately achieved an gathered buying and selling quantity of $2.83 billion in simply 3 months, underlining the potential of buying and selling funding charges.

Within the phrases of 21Shares’ Karim, Senior Digital Asset Researcher:

“$PENDLE potential TAM is the large rate of interest derivatives, which alone symbolize $500T+ in TradFi. Mounted yields aren’t only a pillar of institutional finance, they’re the market” — said AbdelmawlaKarim.

For institutional buyers — asset managers, hedge funds, pension funds and different large-scale capital allocators — the launch of the 21Shares Pendle ETP presents a number of necessary themes: first, that institutional capital is starting to undertake yield-tokenisation platforms; second, that protocols like Pendle are maturing past experimental to investible, regulated-friendly devices; and third, that the broader narrative of DeFi accessing the large fixed-income market is transferring from idea into execution.

Institutional adoption in focus

Institutional buyers sometimes demand scale, liquidity, transparency, and controlled entry. Conventional fixed-income markets supply scale, however typically endure from opacity, illiquidity for some devices, and excessive entry thresholds. Pendle’s structure transforms yield streams into tradeable tokens, enabling entry, transparency, and composability — options that align with institutional tooling. By packaging Pendle’s publicity into an ETP, 21Shares renders this ecosystem accessible by way of acquainted capital-markets infrastructure—custody, reporting, regulatory frameworks—bridging DeFi protocols with institutional workflows.

Latest commentary from analysts reinforces this pattern: one X-post from TheDeFinvestor highlights how yield-tokenization has grown prepared for establishments, underscoring the platform’s revenue-generating capabilities.

What this implies for Pendle and establishments

The flexibility of Pendle to settle tens of billions in yield, coupled with billions in buying and selling quantity by way of Boros, displays each adoption and liquidity — two crucial hallmarks for institutional viability. The 21Shares ETP is greater than a product launch; it’s symbolic of a shift in institutional attitudes towards DeFi-native infrastructure. As Pendle continues to combine real-world property and yield markets, its utility for professionals is more likely to develop.

Wanting forward

With the institutional gateway now established by way of the 21Shares ETP, Pendle is positioned to scale its choices—whether or not by way of fixed-rate devices, yield tokenization of latest asset courses, or deeper tradable merchandise. For establishments trying to entry the ~$140 trillion fixed-income market by means of a programmable, permissionless lens, Pendle provides a up to date avenue.

In abstract, the launch of the 21Shares Pendle ETP alerts greater than recognition—it marks a juncture the place the world’s largest crypto-yield buying and selling platform is coming into the infrastructure of institutional finance. With tens of billions settled, billions in buying and selling quantity, and ETP entry, Pendle is transferring from innovation to institutional-ready infrastructure.

About Pendle

Pendle is the world’s largest crypto-yield-trading platform that allows customers to separate and commerce the long run yield streams of yield-bearing property in DeFi. By enabling the tokenization of each principal tokens and yield tokens, Pendle has created a basis for programmable fixed-income-style publicity in blockchain.

For additional studying, Pendle’s announcement is offered on X:

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome supply on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!