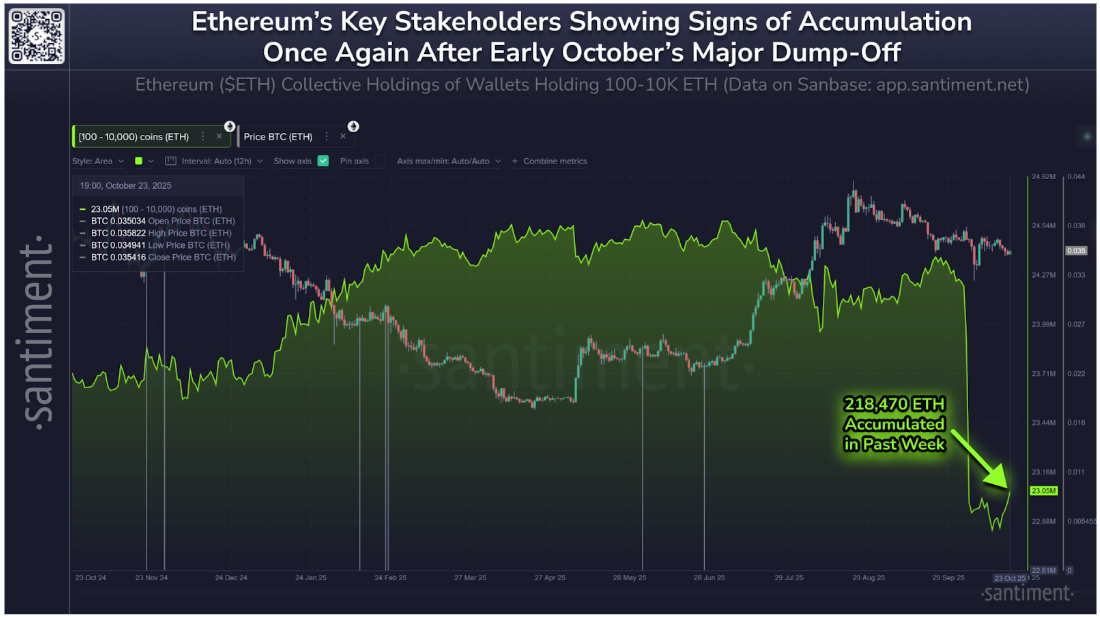

Ethereum’s largest non-exchange holders are tiptoeing back into accumulation. On-chain analytics platform Santiment reported that wallets holding between 100 and 10,000 ETH, also referred to as whales and sharks, have begun to rebuild positions after unloading roughly 1.36 million ETH between October 5 and 16.

Notably, the Ethereum collective holdings chart exhibits that almost one-sixth of these cash have already been clawed again, as some confidence starts to return to the second-largest crypto asset.

Associated Studying

Whales Reverse Course After Early-October Capitulation

The primary half of October was highlighted by one among Ethereum’s most pronounced intervals of capitulation this 12 months. Macroeconomic fears resulting from US tariffs noticed the Bitcoin worth undergo a flash crash that dragged many altcoins to the draw back. Throughout this transfer, Ethereum’s worth also fell very quickly, dropping from highs round $4,740 on October 7 to as little as $3,680 on October 11.

Curiously, on-chain data shows that the promoting stress from massive holders amplified this transfer, because the chart from Santiment exhibits a steep decline of their cumulative holdings from about 24.5 million ETH to roughly 22.6 million ETH. This 1.9 million ETH drop mirrored clear risk-off habits amongst whales and sharks, who had been internet patrons since August.

Nonetheless, as soon as promoting momentum started to fade, accumulation began to return. Institutional inflows began to return into Spot Ethereum ETFs, and whale/shark trades started accumulating Ethereum. Since October 16, the identical cohort that contributed to the liquidation has begun including again to their positions. Santiment famous that these holders are lastly exhibiting some indicators of confidence, demonstrating an incoming prolonged restoration part following the shakeout.

218,470 ETH Added In Final 7 Days

In response to Santiment’s information, the collective holdings of addresses with 100 to 10,000 ETH have rebounded to roughly 23.05 million ETH after bottoming out in mid-October. A highlighted annotation on the chart exhibits that 218,470 ETH had been accrued in simply the previous week, signaling a tangible shift in on-chain habits.

Ethereum collective holdings of wallets holding 100-10,000 ETH. Source: Santiment

This improve represents roughly one-sixth of the cash beforehand dumped, an indication that main traders are regularly re-entering the market after what seemed to be an exhaustion part. Related accumulation traits have usually preceded a broader restoration in Ethereum’s worth, particularly when accompanied by stabilization within the ETH/BTC buying and selling pair.

Because it stands, the Ethereum worth seems to be constructing a firmer base for the subsequent part of its recovery heading into November. When whale wallets accumulate, it reduces the circulating provide obtainable on exchanges and reduces promoting stress.

Associated Studying

On the time of writing, Ethereum is buying and selling at $3,940 and is on track to break and close above $4,000 once more. Each Ethereum and Bitcoin have risen a bit in latest days after inflation report showed US inflation cooling to three% in September, beneath the three.1% forecasted by economists.

Featured picture from Unsplash, chart from TradingView