Ethereum is underneath promoting strain as soon as once more, testing a crucial help stage because the broader crypto market continues to battle for bullish momentum. Altcoins are dropping energy throughout the board, and rising concern amongst merchants has fueled renewed discuss of a possible bear market. The current downturn has pushed Ethereum nearer to its key technical ranges, with buyers carefully watching whether or not it will probably preserve help or if one other leg down is imminent.

Nevertheless, not everyone seems to be bearish. On-chain information from Lookonchain reveals that Bitmine, one of many largest Ethereum holders, simply made an enormous buy — buying 63,539 ETH value roughly $251.6 million. Giant, well timed purchases throughout drawdowns don’t assure a reversal, however they usually reveal the place deep-pocketed members assume worth sits. At a minimal, it injects contemporary demand at a second when sentiment is fragile and reactive.

From right here, the tape issues. If ETH can maintain this help and compress into a better low, the market might begin to deal with the current selloff as a shakeout somewhat than a regime shift. Lose it decisively and the “bear market” calls will possible get louder. For now, Ethereum sits at a crossroads—strain constructing, skepticism rising, and one sizable purchase hinting that the story isn’t completed but.

Bitmine Provides Ethereum Amid Market Weak point

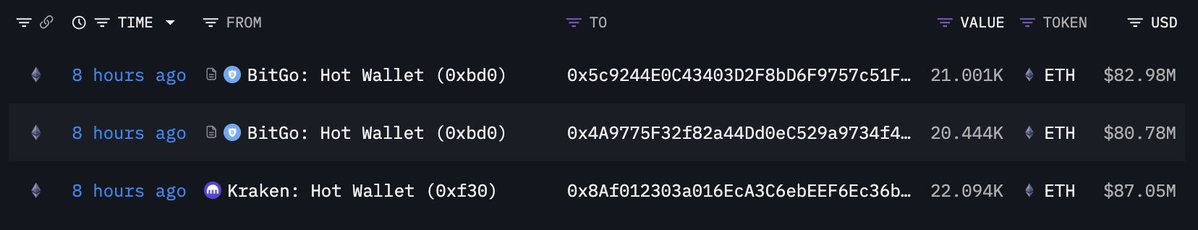

In line with Lookonchain, Ethereum whale Bitmine made a serious transfer simply eight hours in the past — three newly created wallets obtained a complete of 63,539 ETH, value roughly $251.6 million, from Kraken and BitGo. The on-chain exercise sparked renewed dialogue amongst analysts, as such large-scale transfers throughout a interval of promoting strain usually replicate institutional accumulation somewhat than routine repositioning.

This addition pushes Bitmine’s holdings to three,299,553 ETH, valued at round $13.07 billion, representing roughly 2.73% of Ethereum’s complete circulating provide. The sheer scale of this place locations Bitmine among the many most influential holders of ETH, able to impacting each sentiment and liquidity throughout the community. Analysts usually interpret a majority of these actions as confidence alerts, significantly after they happen in durations of heightened volatility.

At a time when Ethereum is struggling to take care of key help ranges and broader market confidence is fragile, such accumulation might function a stabilizing pressure — or a minimum of a psychological one. Traditionally, comparable whale exercise has preceded native worth recoveries as provide tightens and market members reassess short-term bearish bias.

Nonetheless, the broader context can’t be ignored. Ethereum stays susceptible to macro headwinds, and on-chain flows alone might not offset systemic promoting. What’s clear, nonetheless, is that Bitmine’s newest accumulation stands out as a present of conviction — an assertive transfer that means some giant holders nonetheless view present worth ranges as a long-term alternative somewhat than a sign of deeper decline.

Testing A Pivotal Worth Stage

On the 3-day chart, Ethereum (ETH) is trying to stabilize after a interval of sharp promoting strain, at present buying and selling round $3,871. The broader construction nonetheless exhibits an uptrend, however current candles reveal a transparent slowdown in bullish momentum. After peaking close to $4,800, ETH entered a correction that introduced worth again towards the 50-period shifting common (blue line), which now serves as a key short-term help stage.

This zone has traditionally acted as a pivot throughout mid-cycle consolidations, and holding above it could hold Ethereum inside a wholesome market construction. Nevertheless, if ETH loses this stage, the following important help lies between $3,400 and $3,500, the place the 100-period (inexperienced) and 200-period (pink) shifting averages converge — an space that always attracts long-term patrons.

To the upside, ETH wants a decisive shut above $4,000–$4,200 to regain momentum and probably retest the $4,500 resistance, which has been a powerful rejection stage since late September.

General, the 3D chart paints an image of short-term weak spot inside a broader bullish framework. Ethereum’s capability to defend its mid-range help will decide whether or not this correction evolves into accumulation or alerts the beginning of a deeper market retrace.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.