The Bitcoin supercycle idea emerged over the past bull run, when expectations had been that the worth was going to hit $100,000 again then. Naturally, the expectations died down when the bear market rolled round, however with the Bitcoin price now above $100,000, supercycle beliefs are again in full swing. Analyst Weslad highlights this in a put up, displaying that the BTC value is definitely removed from its precise peak if the supercycle continues to be in play.

Why The Fundamental Pattern Indicator Is Essential

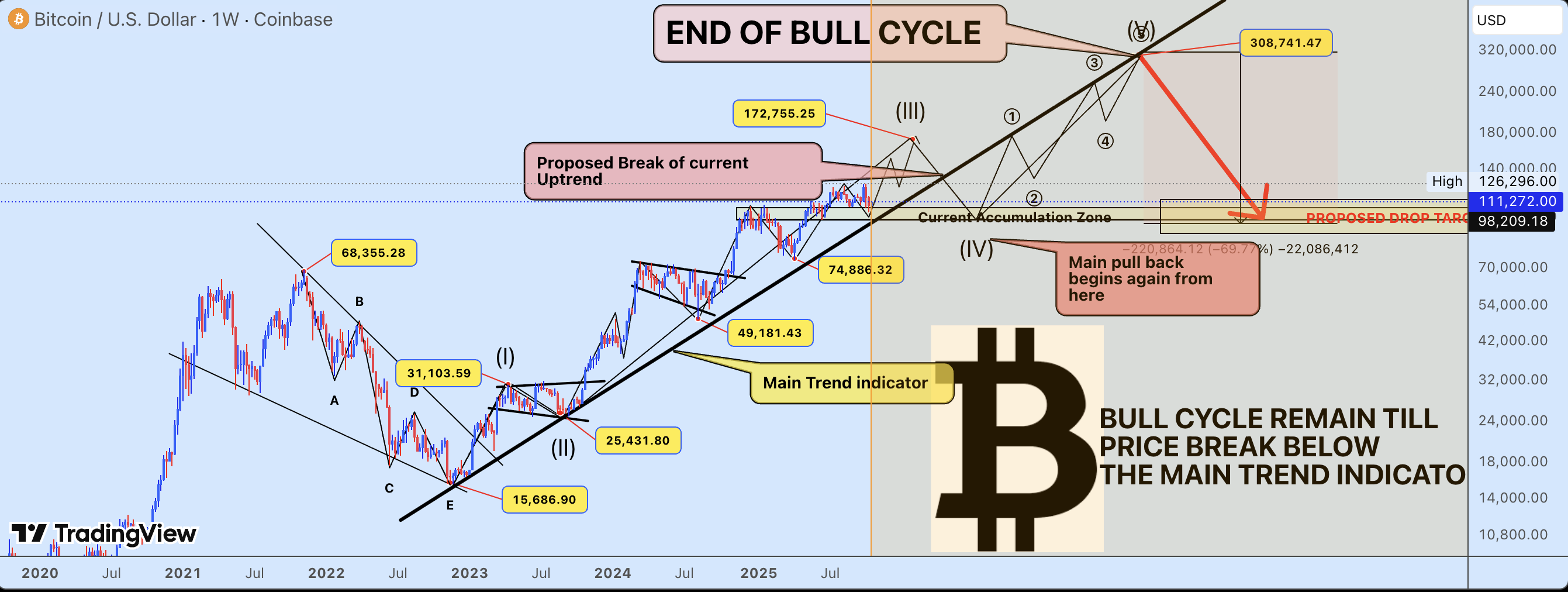

The Bitcoin Fundamental Pattern Indicator is probably an important indicator proper now with regards to telling the place the worth might be headed subsequent. This indicator has its degree set at round $40,000, giving Bitcoin a large berth for what is feasible with regards to maintaining its bullish momentum.

Persevering with to commerce above the Fundamental Pattern Indicator means that the Bitcoin value is still firmly in bullish territory and that the supercycle continues to be in impact. On this supercycle idea, the third Wave continues to be underway and is but to hit its high.

As Weslad explains, if this Wave 3 is accomplished, then the Bitcoin value will hit as excessive as $172,000. This is able to imply an over 50% enhance from the present value degree, and in the end, clearing the requires the cycle high is already in.

However, all of this hinges on the Bitcoin price staying above the Main Trend Indicator. It’s because a break under the indicator triggers a bearish transfer for the digital asset that might be the beginning of the subsequent bear market.

What To Count on For Bitcoin If Wave 3 Completes

A completion of the third Wave would imply that the supercycle pattern continues to be in play, and as soon as the $172,000 of this third Wave is reached, it strikes straight into the extra bearish Wave 4. That is the place the Bitcoin price is expected to start falling.

The crypto analyst expects the Wave 4 to fully erase the good points from the third Wave, pushing it back down toward $107,000 once more. Nevertheless, that is solely the precursor to the fifth and ultimate wave, which is essentially the most bullish.

Weslad expects the final wave to push the Bitcoin value as excessive as $300,000, pointing to the 2020-2021 bull cycle for instance. Similar to now, the BTC value had begun testing a dynamic pattern line and was nonetheless capable of put in new all-time highs regardless of market exhaustion. Thus, it’s doable that Bitcoin completes all 5 waves, rallies to $300,000, earlier than transferring into the bear market.

Featured picture created with Dall.E, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.