Bitcoin has prolonged its rally after a clear breakout from the descending channel, reclaiming major structural ranges and driving towards the $122K–$124K all-time excessive.

Whereas momentum stays strongly bullish, the market continues to be uncovered to a quick pullback towards $114K–$118K to rebalance earlier than any potential continuation towards new highs.

Technical Evaluation

By Shayan

The Every day Chart

Bitcoin has continued its upward enlargement, breaking via the mid-range resistance and invalidating the prior descending construction that outlined September’s worth motion. The breakout was adopted by a fast transfer into the higher boundary of the macro vary, probably concentrating on the buy-side liquidity simply above the all-time excessive round $124K.

The worth is now holding above the breakout stage round $116K–$118K, with the earlier choice level at $112K–$114K serving as key help in case of a retracement. Holding above this zone maintains the bullish construction, holding the $124K–$125K area, the place the subsequent liquidity pool sits, as the first upside goal.

Momentum indicators, nevertheless, recommend the potential for a short-term corrective transfer earlier than continuation, permitting the market to construct a more healthy base for an additional impulsive leg larger.

The 4-Hour Chart

The latest surge from the $108K demand zone triggered an impulsive rally that left behind a number of unmitigated areas of curiosity. The breaker block at $115K–$117K and the Fibonacci retracement cluster between $114.4K and $113.1K now mark the closest re-entry zones for consumers.

A managed pullback towards these ranges would probably entice renewed demand for continuation towards $124K, the place the subsequent main buy-side liquidity cluster lies. If worth maintains its present momentum, a sweep above $124K might happen earlier than a corrective part, aligning with the broader bullish enlargement construction so long as the market holds above $111K–$112K.

Sentiment Evaluation

By Shayan

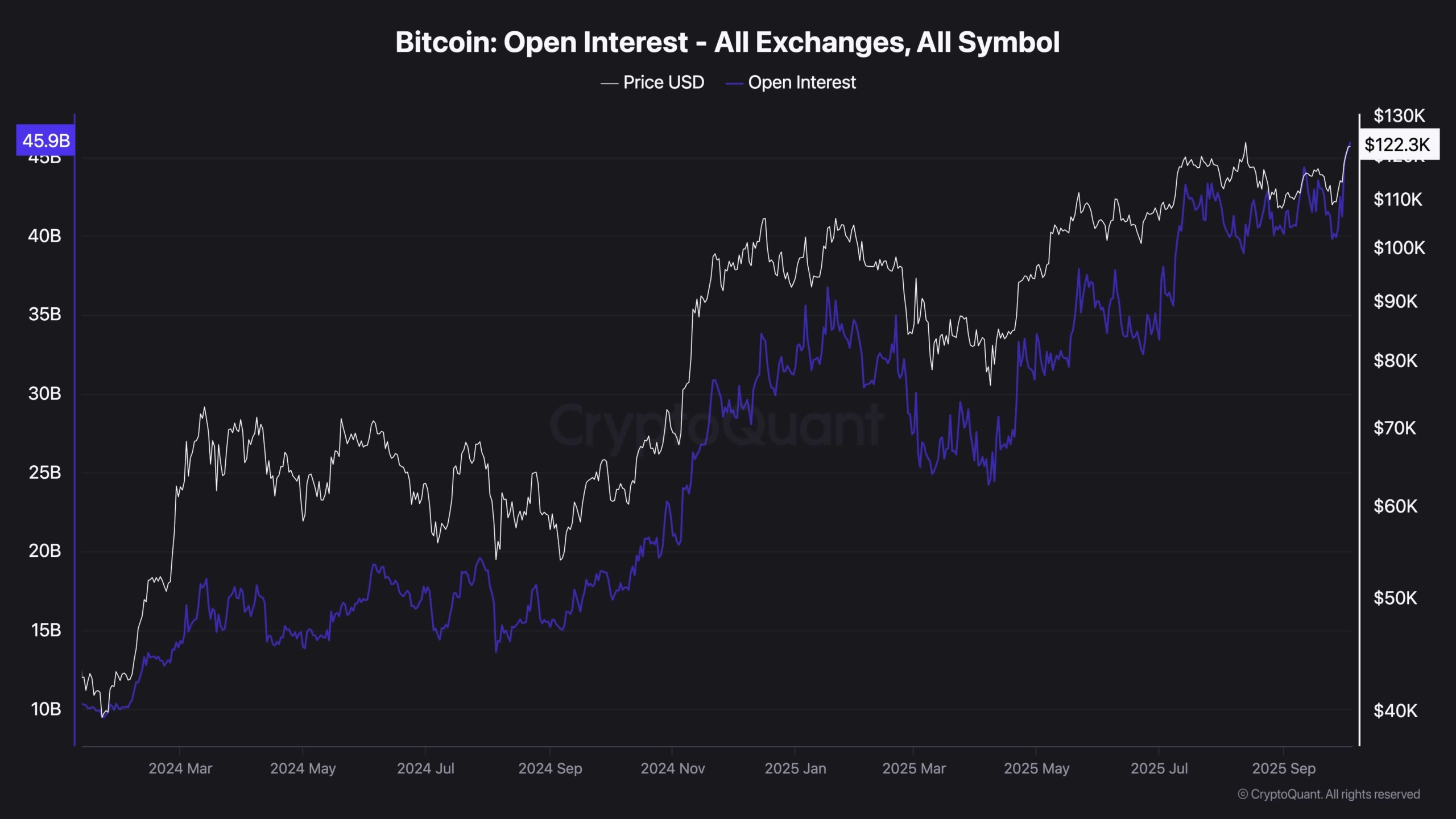

Bitcoin’s open curiosity on Binance has reached a brand new document, edging previous the August peak of $14.306B. This surge coincides with the newest rally, as BTC has climbed from $108K to $124K, whereas open curiosity has expanded from $11.5B to $14.3B in just some weeks. The parallel rise in each worth and open curiosity confirms that the transfer has been powered by recent inflows and new place openings, moderately than a short-covering squeeze.

This enlargement highlights sturdy conviction from merchants on either side, with institutional and retail participation including depth to the market. Nevertheless, the sheer scale of leverage now in play introduces danger. Elevated open curiosity usually acts as a double-edged sword: it will probably amplify upside strikes as trapped shorts unwind, however it will probably simply as rapidly set off liquidation cascades if worth momentum stalls.

For now, the construction favors continuation, with BTC urgent into new liquidity zones between $125K and $130K. But, the hazard lies available in the market’s fragility. If Bitcoin fails to increase larger and consolidates whereas open curiosity stays elevated, the probability of a pointy flush grows, probably dragging worth again towards key demand zones earlier than the broader bullish development resumes.

In brief, record-high open curiosity displays each confidence and vulnerability. Merchants ought to intently watch whether or not open curiosity continues rising or begins to unwind, as this may decide if the subsequent leg extends easily into $130K or if a leverage-driven shakeout interrupts the rally.

The publish Bitcoin Price Analysis: is BTC About to Explode to $130K This Week? appeared first on CryptoPotato.