As soon as a struggling hospitality firm, Metaplanet (TSE: 3350, OTC: MTPLF) has reinvented itself into what it now calls Asia’s Bitcoin rocketship. With its newest buy, the Bitcoin For Corporations member has turn out to be the 4th largest publicly-traded Bitcoin treasury firm on this planet, positioning Japan on the heart of the company Bitcoin motion.

The Treasury Engine: 30,823 BTC and Counting

On October 1, Metaplanet acquired 5,268 BTC for about $615.67 million at a mean value of $116,870 per bitcoin. This brings its whole to 30,823 BTC, value $3.33 billion at price with a mean entry of $107,912 per BTC.

12 months-to-date, the corporate has generated a BTC Yield of 497.1%, far outpacing conventional company efficiency metrics. With over 0.1% of Bitcoin’s fastened provide, Metaplanet has already exceeded its FY2025 goal of 30,000 BTC.

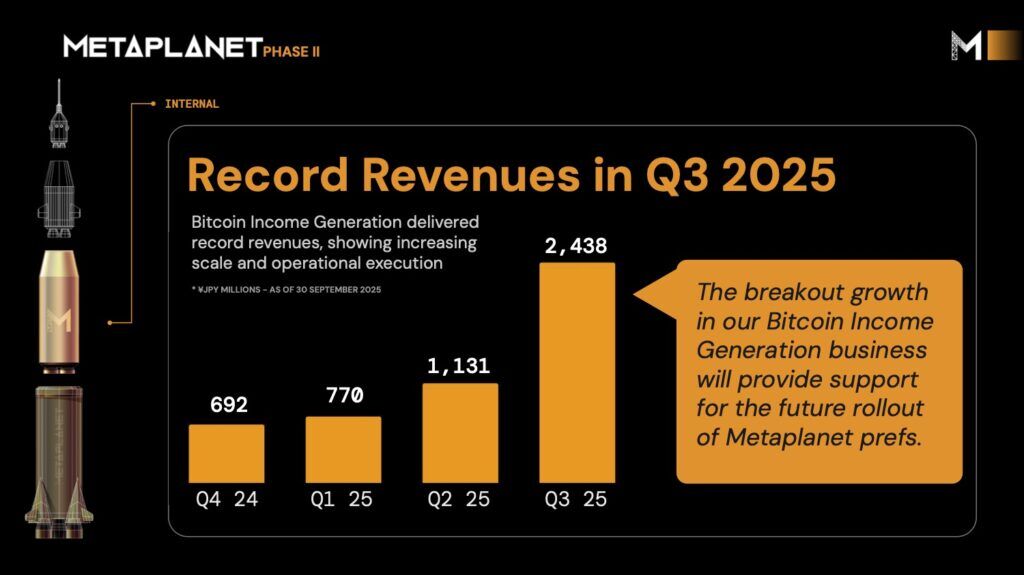

Breakout Quarter: Revenues That Scale With Bitcoin

The corporate’s Bitcoin Revenue Era enterprise has turned market volatility into a brand new form of income engine. Q3 2025 delivered ¥2.438 billion in income, a 115.7% soar from Q2.

On the energy of this development, Metaplanet has doubled FY2025 income steerage to ¥6.8 billion and raised working revenue steerage to ¥4.7 billion. For context, FY2024 income was solely ¥1.06 billion.

In a single 12 months, Metaplanet has gone from modest earnings streams to a scaled Bitcoin-native working mannequin, exhibiting firms that treasury technique and working execution can compound collectively.

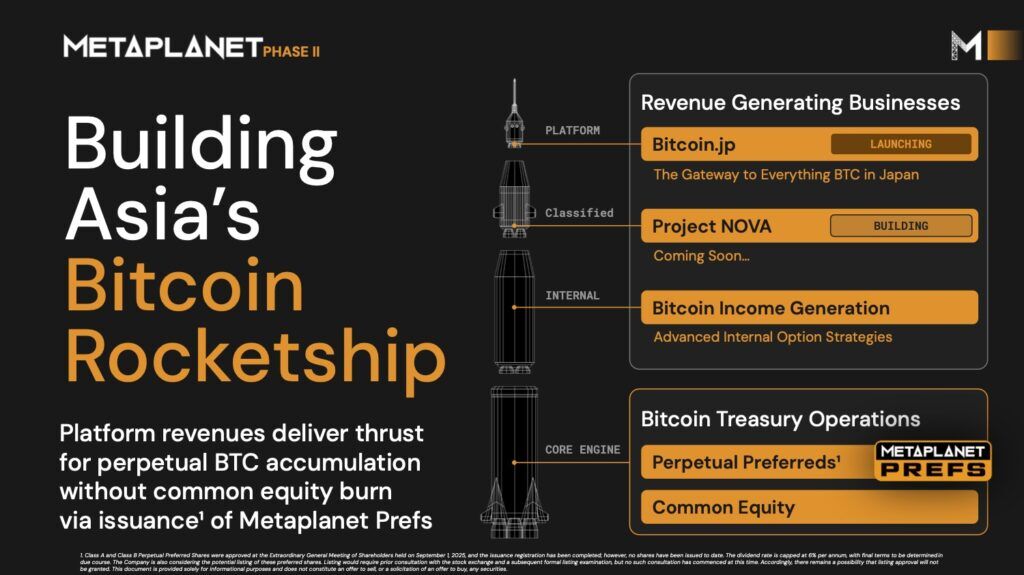

Part II: From Treasury to Platform

Metaplanet’s ambition extends past stacking BTC. The corporate is constructing a vertically built-in Bitcoin platform to broaden earnings streams and fuel perpetual accumulation with out counting on fairness dilution.

- Core Engine — Treasury Operations: Confirmed means to boost over ¥500B and execute above NAV.

- Inner — Bitcoin Revenue Era (Stay): Superior choices monetization and proprietary buying and selling, scaled by a worldwide derivatives workforce.

- Platform — Bitcoin.jp (Stay): Positioned to be Japan’s “house for every thing Bitcoin,” spanning media, training, and monetary companies.

- Categorized — Mission NOVA (2026): Described because the “gateway to every thing BTC in Japan,” NOVA is predicted to seize market inefficiencies and create new distribution channels.

Collectively, these companies present the income thrust for Metaplanet’s treasury mission: maximize BTC per share.

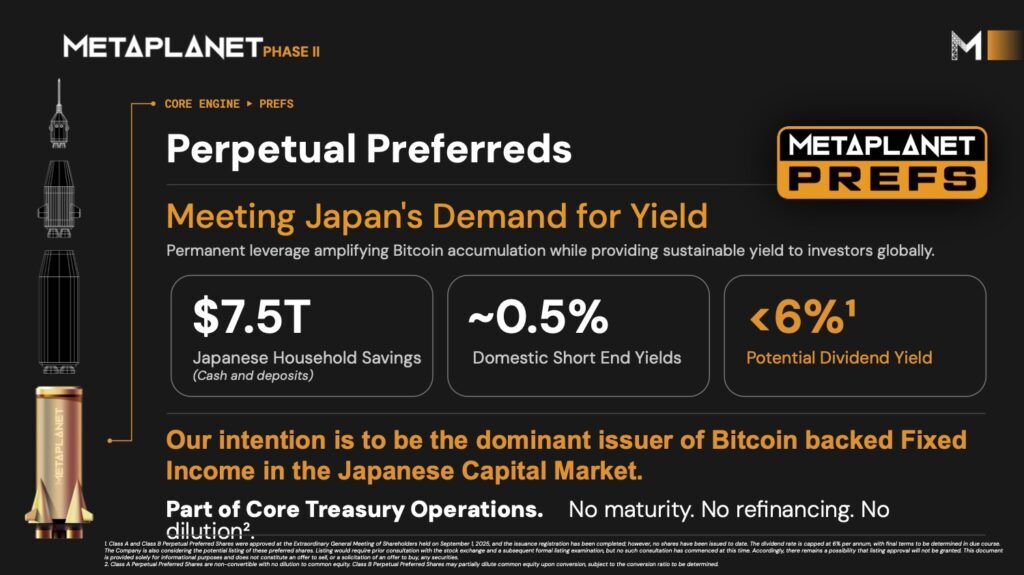

Financing the Future: Perpetual Most well-liked Shares

A cornerstone of Part II is the introduction of Class A and Class B Perpetual Most well-liked Shares, authorised by shareholders in September 2025. These devices provide as much as a 6% dividend yield and are designed to:

- Present everlasting leverage with no refinancing threat.

- Faucet Japan’s ¥7.5 trillion family financial savings pool, the place home yields stay close to 0.5%.

- Broaden Bitcoin accumulation capability to 25% of NAV with out diluting frequent fairness (Class A).

The imaginative and prescient is evident: turn out to be the dominant issuer of Bitcoin-backed fastened earnings in Japan — successfully securitizing the nation’s financial savings surplus into perpetual Bitcoin publicity.

Japan because the Launchpad

Metaplanet’s rise is not only about company execution, however nationwide context. Japan’s unique advantages — excessive financial savings charges, regulatory readability, and a tradition of speedy tech adoption — present fertile floor for Bitcoin-native innovation.

The place the U.S. has Technique (previously MicroStrategy) main as a Bitcoin treasury pioneer, Japan now has Metaplanet positioning itself because the Asian epicenter of company Bitcoin accumulation.

Towards 1% of Bitcoin Provide

The corporate’s long-term aim is audacious: management 1% of all Bitcoin by 2027 — roughly 210,000 BTC. With over 30,000 BTC already secured, ¥500B raised, and new income engines coming on-line, Metaplanet has the momentum to make that concentrate on credible.

For BFC members and company leaders worldwide, the corporate’s ascent provides a playbook: how steadiness sheet technique, operational scalability, and capital markets innovation can converge to create a brand new class of Bitcoin-native public firm.

Disclaimer: This content material was written on behalf of Bitcoin For Corporations. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy or subscribe for securities.