Ethereum is as soon as once more buying and selling at a decisive stage after reclaiming the $4,000 mark, a zone intently watched by merchants and analysts. Bulls have managed to defend the $4,100 space, displaying resilience after weeks of risky worth swings. Nevertheless, momentum stays fragile, and ETH wants a decisive push above increased resistance ranges to verify {that a} pattern shift is underway. With out such a breakout, the chance of renewed consolidation stays on the desk.

Regardless of the uncertainty in worth motion, on-chain knowledge supplies a extra constructive view of the market. Contemporary figures reveal that whales proceed to build up ETH at the same time as broader sentiment has wavered. This regular influx of capital from massive holders suggests rising confidence in Ethereum’s long-term outlook, reinforcing the concept that current corrections might signify alternatives reasonably than weak spot.

Such accumulation has traditionally preceded durations of renewed energy, as deep-pocketed traders have a tendency to construct positions throughout phases of market doubt. If ETH can keep its maintain above $4,100 and construct momentum, whale activity may present the help wanted to spark a stronger restoration. For now, all eyes stay on Ethereum’s capability to maintain this important stage and problem increased resistance zones.

Whale Exercise Alerts Confidence in Ethereum

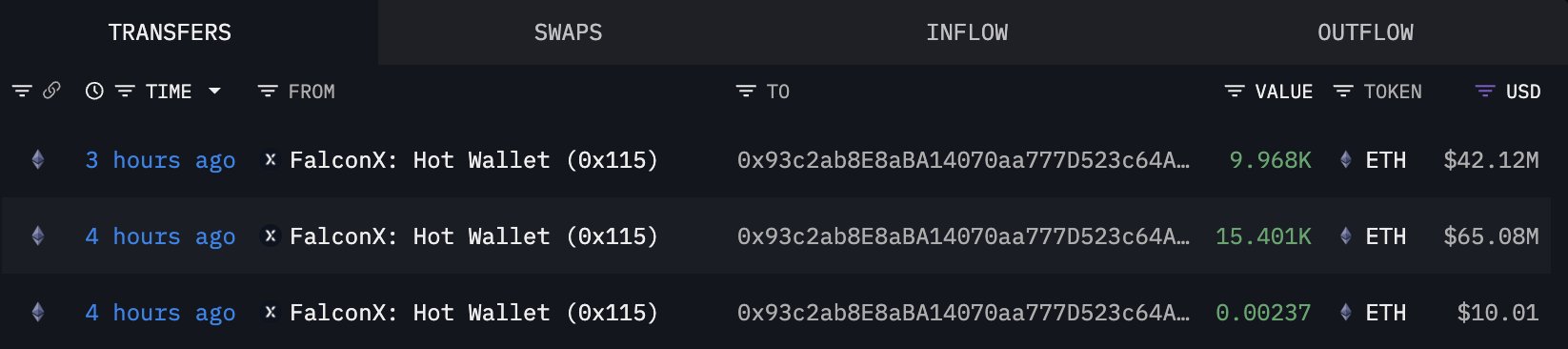

Ethereum’s current worth motion has left merchants unsure, however whale habits tells a distinct story. In line with on-chain knowledge from Lookonchain, massive holders proceed to build up ETH regardless of the current market drop. In simply the previous few hours, two main transactions highlighted this ongoing pattern.

A newly created pockets, 0x93c2 — which analysts counsel might belong to Bitmine — obtained 25,369 ETH, price roughly $106.74 million, from FalconX solely three hours in the past. Such a big influx right into a contemporary pockets suggests strategic accumulation, doubtless meant for long-term holding or staking reasonably than short-term buying and selling. In parallel, one other new pockets, 0x6F9b, withdrew 4,985 ETH (about $21 million) from OKX simply an hour later. These strikes cut back provide on exchanges, typically thought-about a bullish signal because it limits the quick promoting stress.

This sample highlights a broader market dynamic: whereas retail merchants and smaller members react to short-term volatility, whales seem to view the correction as a possibility. Their accumulation not solely demonstrates confidence in Ethereum’s resilience but additionally alerts preparation for future worth appreciation. Traditionally, constant whale inflows into contemporary wallets have coincided with durations of structural help and eventual restoration.

ETH Struggles To Reclaim $4,200

Ethereum is buying and selling close to $4,138 after a risky week that noticed the value tumble beneath $4,000 earlier than bouncing again. The 8-hour chart highlights a restoration try, however ETH now faces important resistance across the $4,200 stage, the place each the 100-period (inexperienced) and 200-period (purple) transferring averages converge. This confluence creates a heavy provide zone that bulls should overcome to verify additional upside momentum.

The current decline from the $4,600–$4,800 vary left Ethereum in a fragile state, with promoting stress intensifying through the drop. The rebound reveals resilience, however worth motion stays capped by overhead resistance, maintaining sentiment cautious. The failure to reclaim the 50-period transferring common (blue) earlier underscores the problem of reversing short-term bearish momentum.

On the draw back, the $4,000 mark acts as the primary important help. A breakdown beneath that stage may re-expose ETH to $3,800 and even $3,600, the place stronger demand might seem. For now, Ethereum trades in a consolidation section, and the subsequent decisive transfer will doubtless rely on whether or not bulls can drive a breakout above $4,200. A clear transfer increased would open the door towards $4,400, whereas rejection dangers renewed draw back stress.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.