The suitcoiners are on the town.

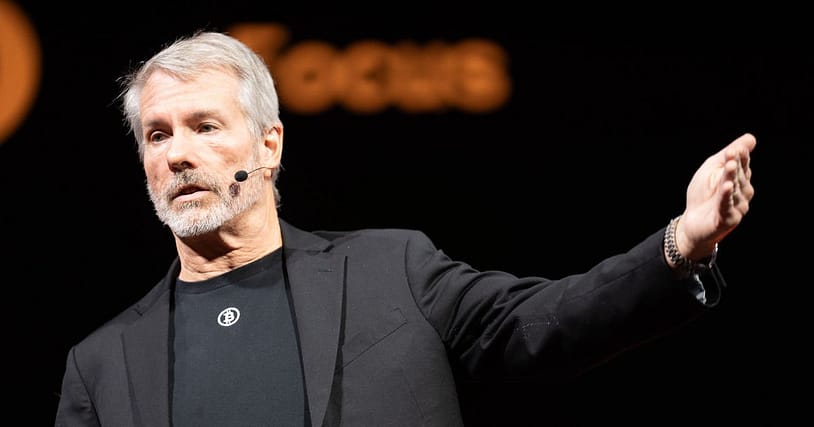

From a low-key, round podium in the course of a lavish New York Metropolis occasion corridor, Technique govt chairman Michael Saylor took the mic and opened the Bitcoin Treasuries Unconference occasion. He joked awkwardly concerning the orange ties, dresses, caps and different merch to the (largely male) viewers of who’s-who within the bitcoin treasury firm world.

As soon as he acquired onto the common beat, it was a lot of the identical: calm and relaxed, talking freely and with confidence, his keynote was heavy on the metaphors and bigger historic tales. Treasury corporations are like Rockefeller’s Normal Oil in its early years, Michael Saylor mentioned: We’ve simply found crude oil and now we’re making sense of the myriad methods during which we will use it — the car revolution and jet gas continues to be properly forward of us.

Established, trillion-dollar corporations not utilizing AI due to “safety issues” make them sluggish and silly — identical to corporations and people rejecting digital belongings now make them poor and weak.

“I’d prefer to suppose that we understood our enterprise 5 years in the past; we didn’t.”

We went from a defensive funding into bitcoin, Saylor mentioned, to opportunistic, to strategic, and at last transformational; “solely then did we notice that we have been completely different.”

Michael Saylor: You Come Into My Monetary Historical past Home?!

Jokes apart, Michael Saylor could be very welcome to the nice and cozy waters of our financial past. He acquitted himself honorably by invoking the British Consol — although mispronouncing it, and misdating it to the 1780s; Pelham’s consolidation of money owed occurred within the 1750s and perpetual authorities debt existed properly earlier than then — and evaluating it to the gold normal and the way forward for bitcoin. He’s proper that Technique’s STRC product in some ways imitates the consols; irredeemable, perpetual debt, issued at par, with the yield fluctuating across the mounted earnings. The distinction is that as an alternative of being backed and issued by the British authorities and managed by the Financial institution of England, STRC is issued and managed by Technique, a non-public enterprise intelligence firm turned proto-bitcoin bank. (And the Financial institution didn’t micromanage the rate of interest to focus on a selected yield.)

We’re within the first yr of reinventing the monetary system, Saylor concluded.

“We are saying that Bitcoin miners recycle stranded power; properly, bitcoin treasury corporations recycle stranded capital.”

Michael Saylor pointed to pension funds and cash market mutual funds and mentioned, “greater than two-thirds of the capital is locked up in structured establishments proper now — it’s capital sitting in a financial institution, a pension fund, an insurance coverage fund, a retirement fund, an institutional funding fund.”

All that might be freed, the bitcoin treasury firm story goes, to be intermediated between the outdated world’s incessant need for “yield” and the brand new bitcoin world that Michael Saylor and Technique is busy constructing.

Michael Saylor thinks that fixing the cash occurs by fixing all the opposite money-adjecent industries: finance, regulation, company governance, safety markets. He remarked, unironically, that in the course of the varied gold requirements, credit score on gold acquired greater than the gold market itself. Implication: there’s a lot extra paper bitcoin to return.

It’s a horrible function mannequin, on condition that self custody, seizure resistance and unstoppable transfers are what bitcoin does so properly over gold. Centralized markets and paperized gold is what broke the outdated world’s “excellent cash.”

Bitcoin Treasuries: Strolling A Tightrope

Towards the top, we acquired a pleasant, little dig at some rival treasury corporations not doing a very good job.

“There’s a sure amount of cash that’ll come to you, that’s simple to get, that’s simply not good for you… it’s laborious to do the issues which are going to create huge shareholder worth in your firm. It’s simple to get massive and do issues that mainly switch your fairness and your collateral to an investor.”

We used to dream of liberating cash from the paper cash system we sleepwalked into in the course of the twentieth century. Right here we’re within the twenty first, our greatest and brightest minds — most of them on this very room — attempting their hardest to make paper out of bitcoin.

It’s a pleasant imaginative and prescient if it really works; if it doesn’t, it’ll be disastrous for the orange dream.