TL;DR

- SEI value varieties a triangle sample, signaling breakout potential if $0.345 stage is cleared quickly.

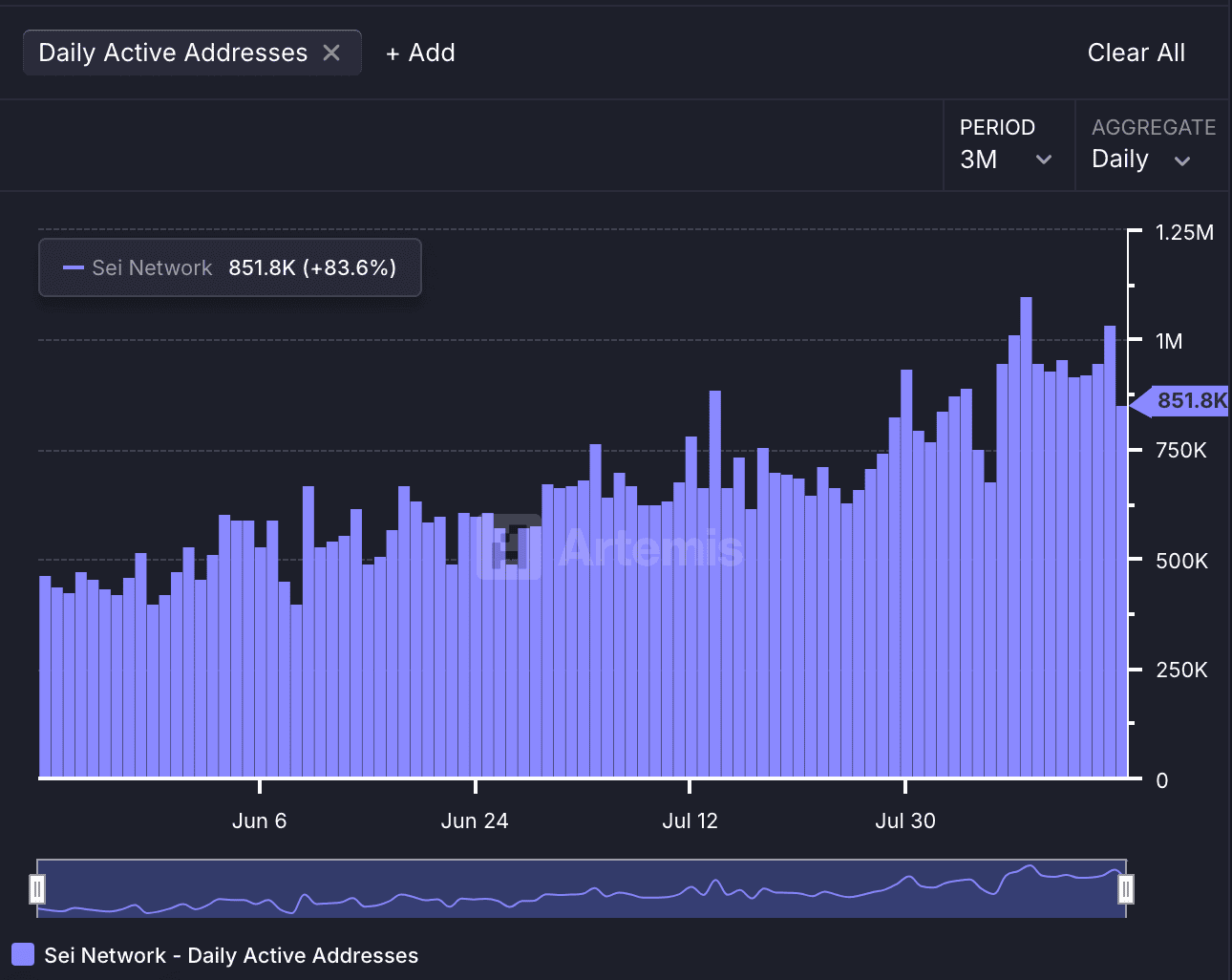

- Energetic addresses up 83% in 3 months, crossing 1 million customers amid rising ecosystem demand.

- Monaco launch provides institutional focus, providing sub-second buying and selling speeds on a decentralized platform.

Value Consolidation Units the Stage

SEI was buying and selling round $0.32 at press time, after a 5% drop up to now 24 hours. Regardless of the decline, analysts are watching the worth intently. On the 4-hour chart, SEI has been shifting inside a symmetrical triangle sample. This formation, marked by decrease highs and better lows, usually results in sturdy directional strikes.

The token is buying and selling just under the $0.33 stage, which aligns with the 50% Fibonacci retracement. Analyst Ali Martinez pointed to $0.31 as a attainable short-term dip stage.

Notably, this space is close to the 0.382 Fibonacci line at $0.317. He added {that a} transfer above $0.35 may very well be the set off for a breakout towards $0.44, which might symbolize a 40% achieve from present costs.

$SEI at $0.31 might be a buy-the-dip alternative earlier than an explosive breakout to $0.44! pic.twitter.com/ro5HcpG8qR

— Ali (@ali_charts) August 18, 2025

New Infrastructure in Focus

Sei Labs not too long ago launched Monaco, a brand new protocol designed for institutional buying and selling. Monaco runs on a Central Restrict Order E-book mannequin and is constructed to help high-speed transactions. The Sei Community weblog reports that it affords execution underneath one millisecond and settlement round 400 milliseconds.

Gordon said, “SEI is constructing the infrastructure for a decentralized Wall Avenue,” describing Monaco as the primary DeFi app straight incubated by Sei Labs. One other analyst, Byzantine Basic, famous that SEI “held up tremendous effectively whereas the remainder of the market dipped,” following the announcement.

Market Information Stays Regular

Open curiosity in SEI futures is holding at steady ranges. This implies that merchants stay engaged with out including excessive ranges of leverage. Quantity stays constant after the early June breakout.

Funding charges on Binance are at the moment at -0.012%. This reveals brief positioning is current, which can create stress if the worth begins to rise. Liquidations have stayed low, which frequently signifies an absence of panic available in the market.

Person Exercise on the Rise

Each day exercise on the Sei Community has grown steadily. Information from Artemis reveals over 851,000 every day lively addresses, which is a 22% rise up to now month. Over a three-month span, the quantity is up by 84%. Some days have crossed a million customers.

In the meantime, this progress displays extra customers interacting with the community. The timing coincides with the discharge of Monaco, which can have helped increase exercise.

The put up SEI Set for 40% Surge? Here’s What You Need to Know appeared first on CryptoPotato.