Block, Inc., based by Jack Dorsey, the co-founder and ex-CEO of Twitter, is a monetary expertise firm with a deepening full-stack connection to the Bitcoin trade by way of its subsidiaries. Its firms span funds apps and service provider tooling with Bitcoin integration, the event of bitcoin mining {hardware}, open supply software program improvement, a decentralized finance protocol for peer-to-peer markets and even a self-custody {hardware} pockets.

Previously referred to as Sq. and founded in 2009, the corporate began integrating Bitcoin into its expertise providing as early as 2014 via Cash App — its most well-known subsidiary — permitting retailers to just accept bitcoin funds by way of the app. In 2021, Square Inc officially rebranded to Block Inc, doubling down on its dedication to Bitcoin and affirming its imaginative and prescient of the long run as one the place the Bitcoin Blockchain would play a pivotal position. Sq. turned a subsidiary of Block Inc and now offers primarily with fee terminal expertise. At the moment, Block has 8,584 BTC on its balance sheet valued at nearly 1 billion {dollars}, with a median buy worth of $30,405 {dollars} per bitcoin.

Of Block’s subsidiaries and investments, most have express connections to Bitcoin or blockchain techniques akin to Money App, Bitkey, Proto, Spiral, TBD and Tidal. All of them are advancing Bitcoin adoption at varied ranges of the trade and have rising affect and gratitude from the Bitcoin neighborhood. Jack Dorsey has been a number one donor to varied Bitcoin nonprofits and neighborhood efforts, together with OpenSats, which funds open supply Bitcoin improvement and thru which an excessive amount of Nostr — a Bitcoin-native social community protocol — has been bootstrapped.

In an unique interview with Bitcoin Journal, Mile Suter, product lead at Block shared insights into their imaginative and prescient for the long run and Bitcoin’s excellent position in it, saying that, “We predict Bitcoin achieves its final future when it’s getting used as on a regular basis cash. Similar to Satoshi supposed. I feel that Bitcoin as a world monetary infrastructure that everybody can entry lets firms like Block function in a way more world method. And I feel that funds are important to sustaining the core properties that make Bitcoin distinctive and in the end will make it win in the long term.”

Under you’ll discover quick overviews of a few of Block’s Bitcoin-related firms, significantly these serving retail, with unique quotes from Suter on how they serve crucial roles within the path to hyperbitcoinization.

Sq.

Launched in 2009, Sq. is a point-of-sale (POS) system enabling retailers to just accept card funds and handle operations like stock, payroll, and enterprise loans. Serving 4 million sellers and processing $241 billion annually as of 2024, Sq. introduced that it started rolling out Bitcoin funds for retailers on the Bitcoin Vegas conference in 2025, permitting them to just accept bitcoin seamlessly by way of its POS {hardware}.

The transfer marks a serious milestone in Bitcoin’s integration with retail fee techniques, establishing a lacking pillar up till now within the enterprise toolkit wanted to actually use bitcoin as a medium of change. “On the Sq. aspect, we have now over 4 million retailers within the U.S. with a full suite of point-of-sale, stock, taxes, reporting, like the very best within the enterprise when it comes to conventional funds processing. This initiative goes past simply Bitcoin funds,” mentioned Suter.

With the full-stack accounting integration of Bitcoin, retailers that wished to just accept the digital foreign money however couldn’t due to lack of tooling now have the door huge open. However the imaginative and prescient is larger than that. “And we’re going to offer a full-stack Bitcoin banking suite particularly designed for small companies,” Suter added, leaning into the rising pattern of bitcoin treasury firms and techniques that’s dominating Bitcoin information at the moment.

Corporations will quickly have all of the instruments to just accept bitcoin funds and put them immediately into their firm treasury relatively than immediately promote bitcoin for {dollars}. In the event that they want liquidity, they’re already capable of put that bitcoin as collateral and get dollar-denominated loans straight to their checking account by way of firms like Unchained — although, indubitably, Block can also be shifting in that route for his or her purchasers. Suter added that “one factor I like about this full-stack Bitcoin banking suite is that we’re democratizing entry to Bitcoin treasury instruments that had been beforehand solely obtainable to giant firms. I imagine that holding Bitcoin in your steadiness sheet shouldn’t simply be a Wall Road luxurious.”

Money App

Money App, maybe probably the most famend model inside the Block portfolio, completes the retail funds aspect of the hyperbitcoinization engine Block is constructing. Launched in 2013, Money App is a consumer-focused digital pockets with a reported 57 million active users in 2024, providing person-to-person funds, debit playing cards, shares and Bitcoin buying and selling, and tax submitting. Money App reported $10 billion in bitcoin-sourced income in 2024, making up 62% the total, by charging ~2% per commerce.

Money App may additionally be the primary mainstream funds app to combine Lightning, Bitcoin’s funds community. It’s on the reducing fringe of the trade, producing the best publicly disclosed, bitcoin-denominated income however working the Lightning Community at 9.7% return. This isn’t some bizarre crypto magic yield, and might solely be achieved by ensuring bitcoin funds are extremely environment friendly and dependable. Suited famous that “to me, it’s proof that Bitcoin is already a functioning fee community, not digital gold. It’s greater than that. And I don’t need to get too into the weeds right here, however I can confidently say that we have now probably the most proficient set of Lightning engineers on the planet engaged on these issues.”

Exalted in regards to the success of Money App’s Bitcoin integration, Suter added that “we’re tremendous enthusiastic about Lightning’s position in making Bitcoin on a regular basis cash as a result of that’s actually, from a Block Inc. perspective, we imagine that’s important for Bitcoin’s future, Satoshi’s unique imaginative and prescient, peer-to-peer digital money.”

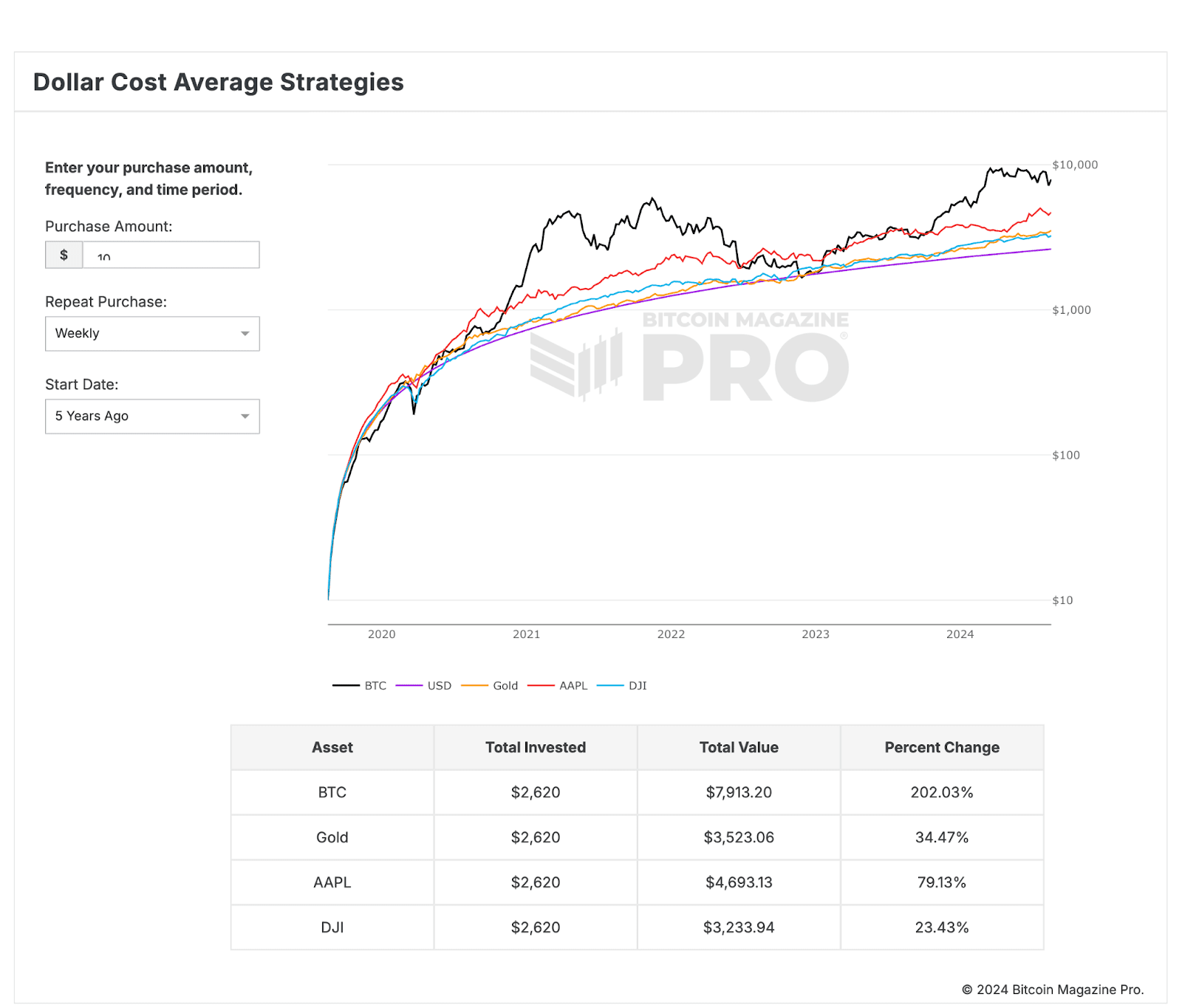

Shoppers can’t simply simply purchase and ship bitcoin by way of Money App, but additionally automate purchases, an funding technique often called DCA or greenback value averaging, which has been mathematically demonstrated to be one of the best investment strategies there are in bitcoin.

The mix of Money App and Sq. unlocks what tech folks name a “fly wheel,” a time period used to explain self-reinforcing loops of shopper and enterprise conduct that may drive a enterprise to new heights and which is often not doable if a constructing block in that enterprise logic is lacking. Maybe with these two main integrations, the imaginative and prescient of Bitcoin funds dreamt about by early adopters for over a decade, which have probably not labored very nicely up till now, can lastly change into a actuality.

Bitkey

Anchored within the elementary worth proposition of Bitcoin — censorship resistance by way of particular person liberty and self custody — Block has launched a brand new {hardware} pockets product referred to as Bitkey. The gadget is designed particularly for Bitcoin safety, utilizing a well-liked expertise referred to as multisignature, which decentralize the passwords — personal keys— wanted to maneuver the bitcoin to a few totally different gadgets: the Bitkey {hardware}, a key saved for restoration in Block’s servers and a 3rd key encrypted with the person’s credentials and saved on the person’s chosen Google drive account.

The Bitkey, launched globally in 2024, makes varied design decisions that depart from the best way different {hardware} wallets within the trade perform — probably the most main and controversial distinction being that it by no means exhibits personal key materials to the person. In contrast to each different {hardware} pockets and most self-custody Bitcoin and crypto apps, Bitkey hides key materials nearly completely from the person, as a substitute giving them varied well-designed instruments to safe, get well and inherit their bitcoin securely to their family members. Suter famous that “we constructed Bitkey to develop who can safely self-custody. We — Bitcoiners — joke that it’s best to onboard your grandma to self-custody, however I hear numerous tales of that being true and folks reaching out as a result of the onboarding was so seamless.”

The gadget appears and seems like alien expertise, each unit with a singular combined stone sample, and that lights as much as the contact, like it’s alive. It’s a profound rethinking of self custody, born of a deep critique of the person expertise of the normal Bitcoin seed backup strategy. Whereas the design has been available in the market for barely a 12 months and no public knowledge on gross sales numbers has been launched, will probably be attention-grabbing to see if they will break new floor into {hardware} pockets adoption — a metric traditionally poor for an trade so culturally outlined by self custody.