ETH continues its sturdy upward momentum, pushing deep into multi-month resistance zones. After breaking out of a chronic consolidation vary, the market has flipped key ranges into assist, with worth now hovering simply round $3,800.

Momentum stays bullish, however short-term exhaustion indicators are starting to floor because the rally stretches greater with out vital retracements.

Technical Evaluation

By Shayan

The Day by day Chart

Ethereum has pushed aggressively by the $2,800 and $3,400 resistance ranges over the previous two weeks, exhibiting very sturdy bullish construction. The 100 and 200-day transferring averages at the moment are on the verge of creating a bullish crossover close to the $2,500 mark, performing as dynamic assist throughout this impulse transfer.

The value has now entered a serious provide zone between $3,700 and $4,100, an space containing a cluster of bearish order blocks. If patrons keep management, the subsequent main goal sits at $4,107, which is the final worth excessive created in early 2024.

Nevertheless, the patrons must be cautious of potential profit-taking on this zone. That is particularly necessary if the value begins to stall across the present resistance vary.

The 4-Hour Chart

On the 4H timeframe, ETH stays in a powerful uptrend, however indicators of weakening momentum are rising. A bearish divergence has fashioned between the value and RSI: whereas the value made a brand new excessive round $3,780, the RSI didn’t comply with by.

This could possibly be an early warning of an area high forming. A clear break under $3,500 might set off a pullback into the $3,200 assist zone, which is now structurally vital.

Nonetheless, till that happens, ETH stays bullish on this timeframe. The pattern is supported by a wholesome construction of upper highs and better lows, and quantity has remained elevated. Merchants ought to maintain an in depth eye on how ETH behaves within the $3,800–$4,100 zone. A breakout right here opens the door to a full continuation transfer, whereas rejection and bearish follow-through would sign a cooling-off interval.

Sentiment Evaluation

Ethereum Open Curiosity

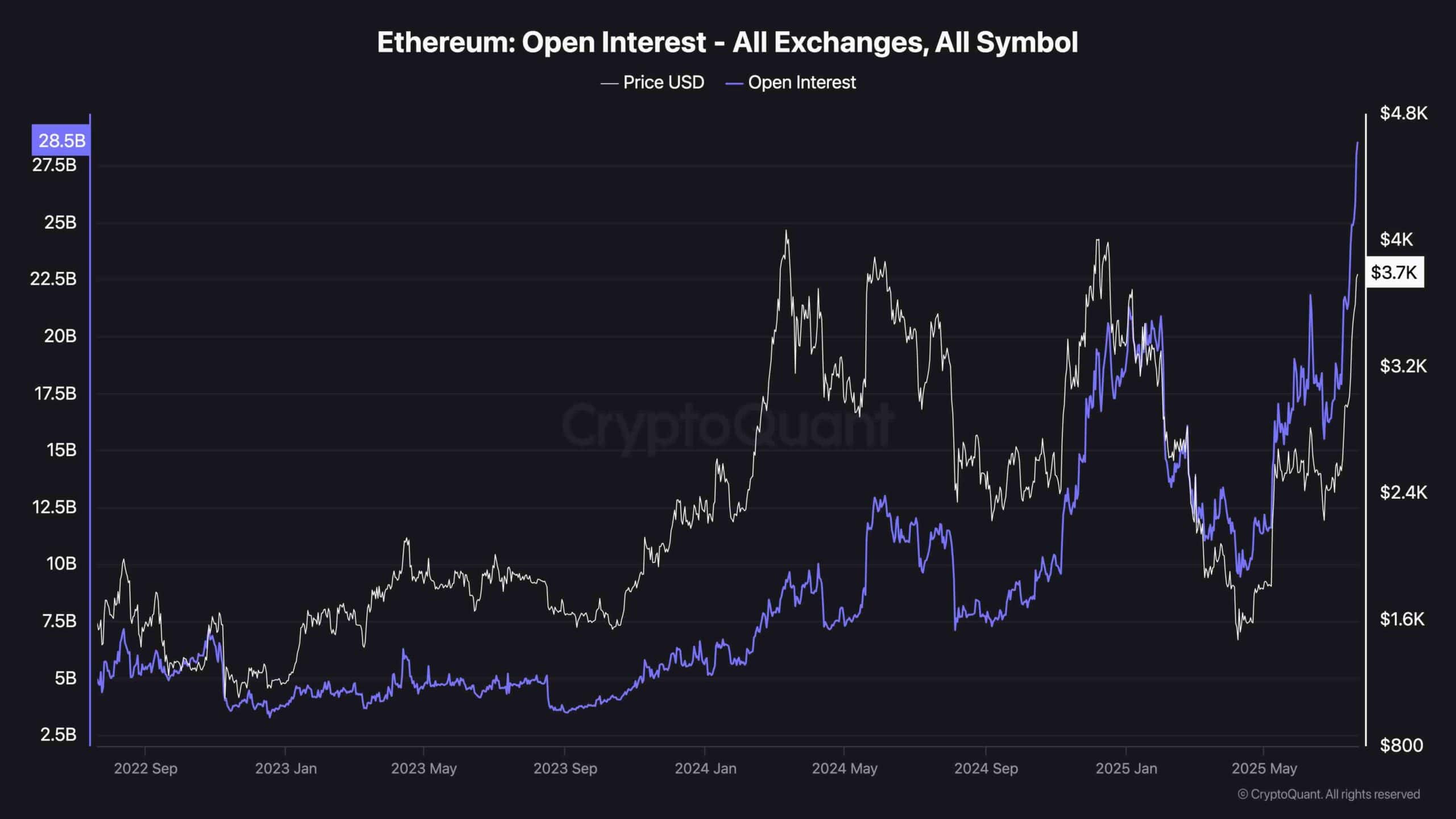

The Open Curiosity chart paints a transparent image of rising market participation. OI has surged to its highest degree over the previous few years, now sitting above $28B.

What makes this spike notable is that it comes throughout a powerful worth breakout, indicating the rally is being pushed not simply by spot shopping for, but in addition closely by leveraged positions. This may be each a bullish and dangerous signal.

As OI climbs in keeping with worth, it’s crucial to watch for any indicators of lengthy liquidations or sudden deleveraging. If ETH stalls or rejects from resistance and open curiosity stays excessive, the market could possibly be weak to a pointy flush. For now, nevertheless, this information confirms sturdy bullish sentiment and sustained speculative curiosity in ETH’s breakout.

The put up Ethereum Price Analysis: ETH Targets $4K Following 25% Weekly Gains appeared first on CryptoPotato.