Officers from Shenzhen have issued cautionary recommendation to the general public, recommending that they pay most consideration when working with stablecoins as a result of mounting reviews of abuse from sure schemes.

As these property turn out to be extra extensively adopted and mentioned, this seems to be a step again from the nation’s plans to introduce a yuan-backed stablecoin.

The Hype Round a Product Does Not Imply Legitimacy

China’s authorities has released a discover, stating that sure dangerous actors are exploiting the general public’s restricted information of stablecoins, utilizing flashy phrases to lure of their victims. Slogans similar to “monetary freedom” and “digital wealth” are used to tempt individuals into varied scams.

On this discover, the Workplace of the Particular Working Group for Stopping and Combating Unlawful Monetary Actions suggested of the next:

“These entities exploit new ideas similar to stablecoins to hype up so-called funding initiatives involving ‘digital currencies,’ ‘digital property,’ and ‘digital property”

The perceived decrease volatility in comparison with different cryptocurrencies could make stablecoins a driving pressure behind the growing connections to illicit actions related to them. The authorities went additional by stating:

“They have interaction in false public promoting to solicit funds from the general public, giving rise to unlawful actions similar to fundraising, playing, fraud, pyramid schemes, and cash laundering.”

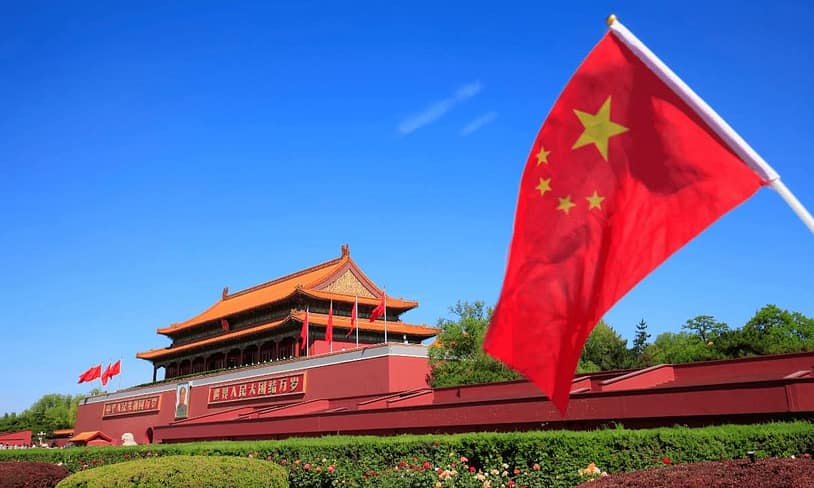

This can be a worrying pattern, contemplating that cryptocurrency buying and selling has been banned in China, along with different prohibitions on mining.

All of the whereas, that is occurring because the nation makes an attempt to maneuver ahead with its personal state-backed stablecoin plans.

Circle’s CEO, Jeremy Allaire, was optimistic throughout the Binance Blockchain Week concerning the general world adoption ranges and leaned extra in the direction of individuals’s choice for stablecoins over central financial institution digital currencies (CBDCs).

How Stablecoins Are Faring Round The World

The stablecoin market cap has skilled vital development just lately, with roughly $50 billion added to a complete of $255.6 billion this 12 months alone, in keeping with the newest knowledge from DefiLlama.

Tether’s flagship product (USDT) stays the main stablecoin, with a market share of $159.4 billion, adopted by Circle’s USDC with $61.9 billion.

The latter just lately joined the New York Inventory Trade (NYSE) with the ticker image CRCL, bolstering a market capitalization of $45.7B as of the time of writing.

This widespread adoption can be probably sparked by elevated regulatory frameworks, such because the GENIUS Act, which passed the Senate with a 68–30 vote final month.

Main retail names are additionally interested in launching their very own stablecoins, aiming to scale back prices and improve the client expertise.

Furthermore, a number of the largest US banks are additionally not too far behind in comparable initiatives.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome provide on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!