Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tron has captured renewed consideration following a significant improvement: its deliberate entry into public markets. Justin Solar, Tron’s founder, has reached a take care of Nasdaq-listed SRM Leisure (SRM.O), beneath which SRM will purchase Tron-related tokens, rebrand as Tron Inc., and appoint Solar as an adviser. This transfer marks a major step in bridging the hole between blockchain initiatives and conventional finance, doubtlessly making Tron one of many first main public blockchain entities.

Associated Studying

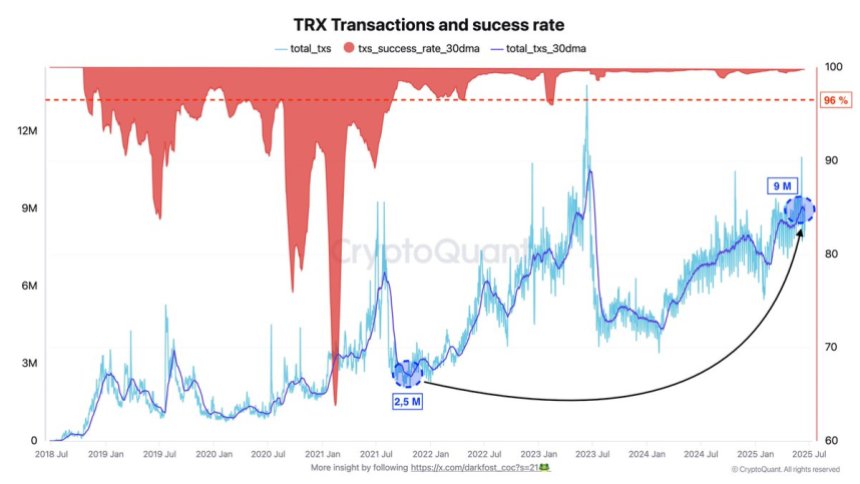

In the meantime, rising geopolitical tensions within the Center East have sparked volatility throughout the broader crypto market, together with Tron. Regardless of this unsure macro atmosphere, Tron’s on-chain fundamentals stay robust. Prime analyst Darkfost shared information exhibiting that Tron’s each day transaction quantity has surged from 2.5 million in 2021 to over 9 million at this time. This exponential development underscores a pointy rise in consumer exercise and developer engagement throughout the community.

The sustained enhance in transaction quantity additionally displays growing confidence in Tron’s infrastructure as a scalable and dependable different to different high-throughput blockchains. With each institutional publicity through SRM and robust on-chain development, Tron finds itself at a pivotal second in its evolution—one that might reshape its trajectory within the months forward.

Tron Retraces After Public Itemizing Surge: Community Fundamentals Stay Sturdy

Tron is at present buying and selling round key demand ranges after a pointy retrace from Monday’s breakout rally. The surge—triggered by the announcement that Tron would go public through a take care of Nasdaq-listed SRM Leisure—briefly despatched TRX up over 9%, producing widespread consideration. Nevertheless, escalating tensions between Israel and Iran have weighed on market sentiment, dragging the worth again to pre-announcement ranges.

Regardless of short-term volatility, Tron’s fundamentals proceed to color a bullish image. According to Darkfost, the Tron blockchain has demonstrated robust and constant development since 2021. Every day transaction volumes have risen from 2.5 million to over 9 million, reflecting rising adoption and sustained demand for its infrastructure. This exercise surge indicators heightened investor curiosity and developer confidence within the community.

But, excessive quantity alone doesn’t assure high quality. What units Tron aside is its spectacular transaction success fee, which has remained above 96% all through this development part. This reliability counters criticisms typically aimed toward different high-throughput chains like Solana, the place failed or spammy transactions can inflate metrics.

Moreover, Tron’s block manufacturing has remained secure and linear, showcasing its operational consistency. Even amid rising international transaction charges, Tron continues to draw utilization, suggesting that customers nonetheless view it as an economical, scalable resolution. This mix of excessive efficiency, robust demand, and community resilience positions Tron as some of the technically mature blockchains within the present market cycle. If macro situations stabilize, Tron’s public itemizing and sturdy on-chain metrics may reignite bullish momentum.

Associated Studying

TRX Worth Evaluation: Key Help Ranges Maintain

Tron (TRX) is at present buying and selling at roughly $0.273, consolidating simply above the 50-day easy shifting common (SMA), which sits round $0.268. After a pointy spike on Monday that pushed the worth towards $0.30 following the announcement of Tron going public, the worth retraced again to pre-announcement ranges amid escalating geopolitical tensions within the Center East. Regardless of this pullback, TRX stays in a bullish construction on the each day chart.

The 100-day and 200-day SMAs, at present round $0.252 and $0.253, respectively, proceed to development upward and act as stable dynamic assist, confirming that the medium- to long-term development stays intact. Quantity surged on the breakout however has since cooled, which is predicted in periods of consolidation.

Technically, TRX is forming a better low construction whereas staying inside a broader uptrend that started in late March. So long as the worth holds above the $0.268 assist stage, bulls might try one other push towards $0.285 and doubtlessly retest the current excessive close to $0.30.

Associated Studying

A break beneath $0.268 may invalidate the bullish momentum and set off a transfer towards the $0.252–$0.255 zone. For now, worth motion stays constructive as TRX holds above all main shifting averages and key structural assist.

Featured picture from Dall-E, chart from TradingView