Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has weathered a wave of volatility in latest days, triggered by the escalating battle between Israel and Iran. As geopolitical tensions rise and international markets grapple with uncertainty, danger property like BTC have confronted elevated stress. But regardless of this turbulent backdrop, Bitcoin has managed to keep up its footing above key assist ranges, demonstrating notable resilience.

Associated Studying

At present buying and selling slightly below its all-time excessive, Bitcoin is in a consolidation section that many analysts view because the calm earlier than a possible breakout. Prime analyst Rekt Capital shared insights indicating that the ultimate main Weekly resistance, which has beforehand capped worth rallies, could now be weakening as some extent of rejection. If confirmed, this shift might sign a essential turning level available in the market construction and open the door to cost discovery.

Traders are watching intently as BTC holds strong whereas macro headwinds—together with rising US Treasury yields and fears of vitality disruptions—proceed to swirl. With the broader market bracing for additional developments within the Center East, Bitcoin’s skill to keep up larger lows and method resistance with momentum means that the bulls could quickly reclaim full management. The approaching days might show pivotal for the following section of BTC’s market cycle.

Bitcoin Awaits Readability As Center East Tensions Form Market Sentiment

The battle between Israel and Iran continues to dominate headlines and exert affect over international markets. As tensions escalate, buyers stay cautious, intently monitoring geopolitical developments and their macroeconomic ripple results. On this unsure surroundings, Bitcoin has entered a consolidation section, with neither bulls nor bears absolutely in management.

The dearth of a transparent path stems from diverging investor expectations. Optimistic market individuals anticipate {that a} diplomatic decision could also be reached within the coming days or even weeks. A peace deal might cut back market anxiousness, drive oil costs decrease, and reignite momentum throughout danger property—Bitcoin included. Then again, extra cautious buyers concern that the scenario might worsen. Extended battle could spark volatility within the vitality sector, push inflation larger, and pressure financial stability, notably in areas depending on oil imports.

This week could show decisive for Bitcoin’s subsequent main transfer. Worth motion stays tightly certain, however all eyes are on the long-standing Weekly resistance. According to Rekt Capital, the ultimate main Weekly resistance—as soon as a powerful rejection level—now seems to be weakening. This shift in construction means that Bitcoin could also be getting ready for a breakout into worth discovery territory, ought to macro situations stabilize.

Associated Studying

BTC Worth Holds Above Key Help Amid Consolidation

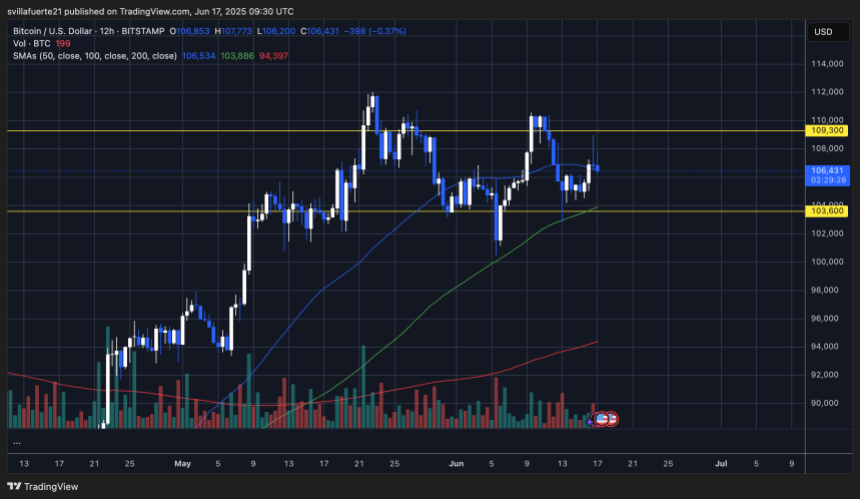

The 12-hour chart for Bitcoin reveals that BTC continues to commerce inside a decent vary, holding above the essential $103,600 assist whereas struggling to interrupt cleanly by the $109,300 resistance. This zone has repeatedly acted as a ceiling for worth motion since early Could, with sellers stepping in round $109K and consumers defending dips close to $104K.

The latest bounce from simply above the $103,600 degree displays ongoing purchaser curiosity at that vary, strengthened by the 100-day SMA (inexperienced), which is offering dynamic assist. In the meantime, the 50-day SMA (blue) is curling barely upward, exhibiting early indicators of constructive momentum, though the worth has but to obviously reclaim and maintain above it.

Quantity stays average, indicating a scarcity of sturdy conviction on both facet. For bulls to regain full management, BTC should push by the $109,300 resistance with sustained quantity and maintain that breakout degree. A failure to take action could end in one other rejection and a possible retest of the decrease boundary close to $103,600.

Featured picture from Dall-E, chart from TradingView