A extensively adopted crypto analyst says that Bitcoin (BTC) could pull again after failing to carry a key assist degree.

In a brand new thread, crypto dealer Justin Bennett tells his 116,000 followers on the social media platform X that BTC could revisit the decrease sure of a buying and selling vary on the $100,000 degree, after a potential weekend bounce.

“Potential situation for BTC following Thursday’s $106,600 failure. Pull again/consolidate on Friday, weekend rally (as a result of that’s what retail does) into $106,000-$107,000, after which revisit the $100,000 lows. Invalidation on a sustained break (excessive time frames) above $107,000…

Personally, I wouldn’t be a purchaser right here, not after shedding $106,600. It’s shorts just for me, however provided that BTC provides me the chance on a bounce.”

Bennett additionally says that BTC whales exiting lengthy positions in favor of constructing quick positions in opposition to retail is inflicting the flagship crypto asset to weaken.

“Whales had been shorting into retail energy all day Thursday. It was a rip-off BTC pump from the beginning.”

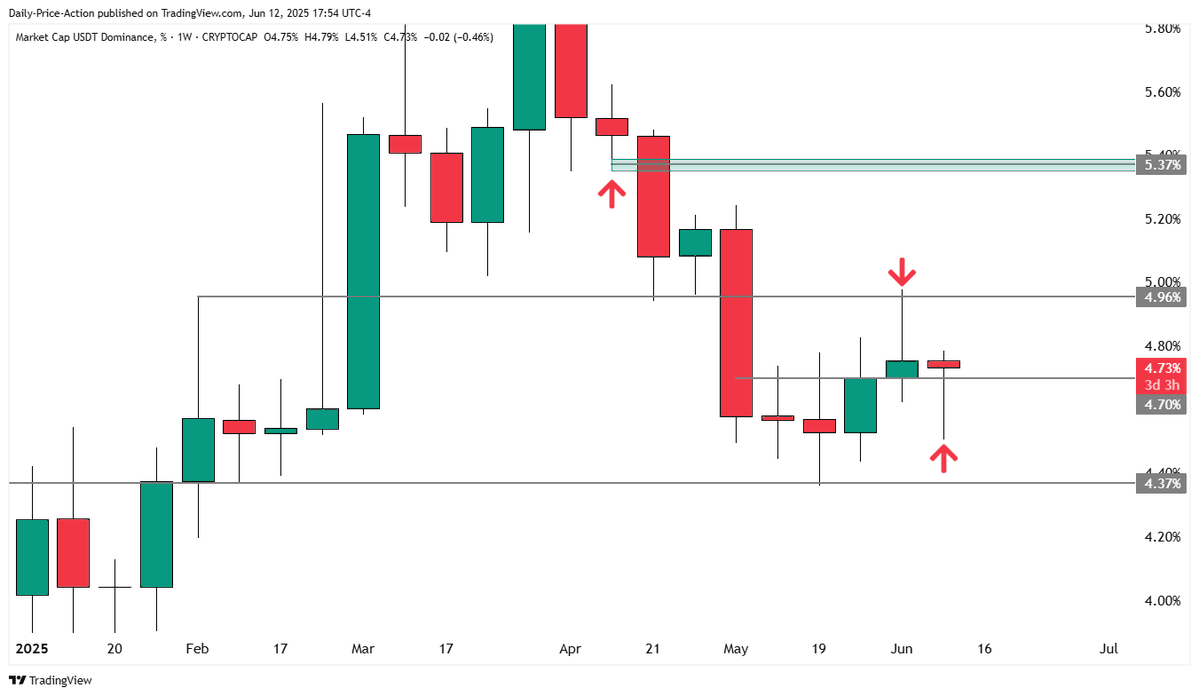

Lastly, the analyst warns that the USDT dominance chart (USDT.D) could begin flashing bearish for Bitcoin.

Many merchants carefully watch the USDT.D chart because it reveals how a lot of the crypto market cap is comprised of the stablecoin USDT. A bullish USDT.D chart is mostly thought-about bearish for Bitcoin and different cryptocurrencies because it signifies merchants are unloading their crypto holdings in favor of the stablecoin.

“Not able to name it simply but, however the USDT.D weekly chart is beginning to look primed for one more push again to five%. I’ll anticipate Friday’s two-day near get a extra definitive reply on this concept, but it surely appears to be like respectable up to now. (Tether dominance strikes inversely to BTC and ETH).”

Bitcoin is buying and selling for $105,658 at time of writing, down 1.6% within the final 24 hours.

In the meantime, USDT.D is at 4.79% at time of writing.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney