Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Though the previous 24 hours have been characterized by heavy selloffs, Bitcoin remains to be at present holding above the $100,000 degree, buying and selling round $103,700 as of the time of writing. Notably, indicators of exhaustion are also beginning to surface for Bitcoin, particularly prior to now 48 hours.

Whereas long-term indicators recommend a bullish continuation for the Bitcoin worth, short-term fashions point out a breakdown of bullish energy, significantly because the cryptocurrency approaches the vital $100,000 help zone.

Associated Studying

This sentiment is relayed by fashionable crypto analyst Willy Woo, who shared the good and bad news based mostly on Bitcoin’s present technicals.

Good Information: A Bullish Lengthy-Time period Sign Nonetheless Intact

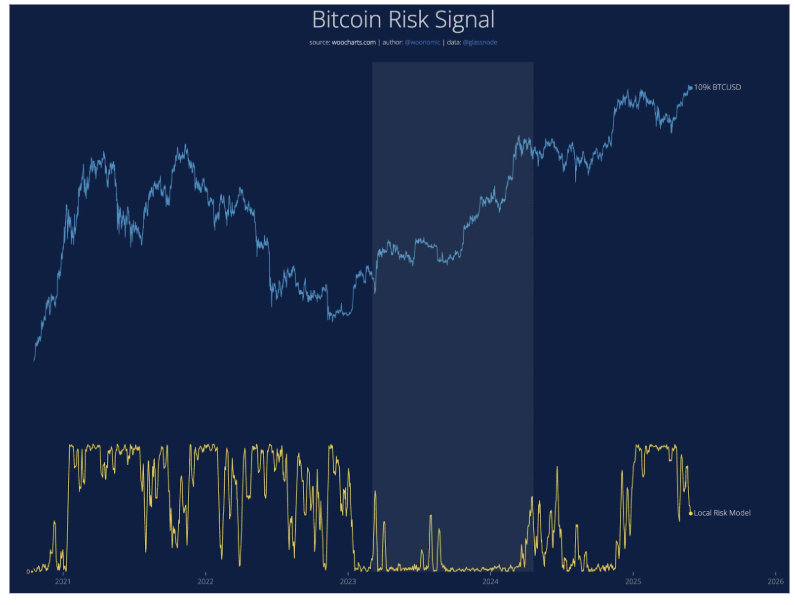

According to Woo, one of many strongest long-term alerts, the Bitcoin Threat Sign, is at present trending downwards. This drop signifies that buy-side liquidity is at present dominant within the long-term atmosphere, setting the stage for an additional sturdy leg upward.

The decrease the danger studying, the safer it’s to carry or accumulate Bitcoin, and this sign’s present decline exhibits a comparatively low-risk atmosphere for long-term buyers.

Woo famous that this long-term setup is undamaged, and with Bitcoin buying and selling nicely above the psychological six-figure mark, the momentum remains to be in favor of the bulls in the long term.

On the time of writing, the native threat mannequin, as proven within the chart beneath, is at present within the mid-range, having declined from peak ranges in early 2025, and is predicted to proceed trending downwards. In one other evaluation, Willy Woo famous the subsequent vital transfer might push it above $114,000 and set off liquidations of quick positions.

Unhealthy Information For Bitcoin Worth

Though the long-term image remains to be favorable, the short-term fashions, together with the Hypothesis and SOPR (Spent Output Revenue Ratio) metrics, are flashing caution. Utilizing this indicator, Woo noted that the energy of the rally from $75,000 to $112,000 has began to weaken, particularly with flat capital influx prior to now three days.

Conserving this in thoughts, Bitcoin’s worth motion this week is vital. “If we don’t get observe by means of, then we shall be up for an additional consolidation interval,” the analyst said. If spot shopping for fails to choose up strongly within the coming week, which is the primary week of June, particularly with U.S. markets reopening after a protracted weekend, there shall be an opportunity for a bearish pivot.

The great and unhealthy information could be summed up as follows: if shopping for stress opens up shortly, Bitcoin might break above $114,000 and head towards the subsequent main liquidity zone between $118,000 and $120,000. Failure to push increased might confirm bearish divergences and set the stage for an additional spherical of consolidation.

Associated Studying

On the time of writing, Bitcoin is buying and selling at 103,700, down by 1.5% and three.9% prior to now 24 hours and 7 days, respectively.

Featured picture from Unsplash, chart from TradingView