Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink’s token, LINK, has barely budged this month. It sits in thirteenth place by market cap after choosing up simply 3.8% since Might 1. Its worth hovers below $12 at occasions, although some studies put it close to $16 when markets final ticked. That blended image raises questions on whether or not LINK can maintain its spot.

Associated Studying

Cross-Chain Push Comes To Solana

In response to revealed updates, Chainlink rolled out its Cross-Chain Interoperability Protocol on Solana on Might 19, 2025. This function goals to let builders faucet into over $18 billion in belongings throughout chains.

The improve is supposed to assist Solana’s DeFi world hyperlink up with Ethereum, Polygon, Avalanche and others. It exhibits Chainlink’s staff isn’t ready round for the worth to climb.

⬡ Chainlink Adoption Replace ⬡

There have been 16 integrations of the Chainlink normal throughout 6 providers and 16 completely different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync.

New… pic.twitter.com/j3cnAnc3UC

— Chainlink (@chainlink) May 25, 2025

New Integrations Add Momentum

Based mostly on studies from the Chainlink staff, there have been 16 recent integrations of its requirements. These span six service sorts and embrace assist on Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Polygon, Solana and ZKsync.

Developer exercise is on the rise. However that development hasn’t sparked massive strikes within the LINK market but. A $10.4 billion market cap nonetheless feels sturdy. But the token’s flat efficiency places stress on its rating.

Resistance Zones Form Outlook

Merchants eye key hurdles on the LINK/USDT chart. First up is a wall at $20, a degree the place sellers have stepped in earlier than. A push previous that would ship LINK towards a $25–$26 space. Past lies a mid-term goal of $28–$30, matching late-2024 highs.

Quantity spikes in April did set off a 14% climb, pointing to potential repeat motion. However bears nonetheless have a say. The MACD line sits below its set off line, although the hole is slender. Histogram bars are flat, hinting that promoting power could be fading. A crossover may spark recent shopping for.

$LINK‘s downtrend channel is about to interrupt out.

This rise is more likely to proceed easily to the $36.5 degree, the place there’s a promoting wall. pic.twitter.com/CaN2agtchk

— CW (@CW8900) May 26, 2025

Breakout Indicators

In the meantime, LINK is displaying indicators of breaking out of its downtrend channel, sparking bullish momentum amongst merchants. Analysts word {that a} clear breakout may push LINK towards the $36.5 degree, the place a serious promoting wall sits.

The transfer follows elevated developer exercise and Chainlink’s CCIP launch on Solana. If consumers maintain momentum, LINK might rally easily—however the $36.5 resistance may take a look at the power of this breakout.

Flat Forecasts Hold Hopes Modest

Technical indicators are blended. LINK’s one-month forecast exhibits a 0.61% achieve by June 26, 2025, touchdown it round $15.64. That outlook comes with a “Impartial” studying on market sentiment.

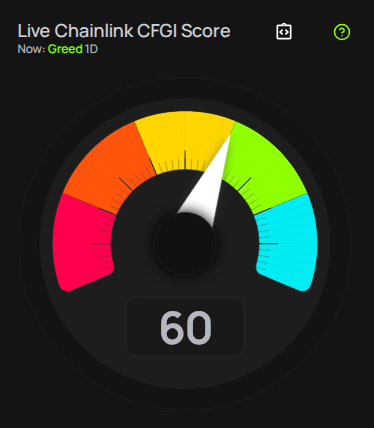

Supply: CFGI

The Worry & Greed Index sits at 60, an indication of Greed. Up to now 30 days, LINK had 12 inexperienced days out of 30 and noticed 6.40% volatility. All that factors to modest strikes reasonably than wild swings.

What Comes Subsequent For LINK

Chainlink’s core aim stays the identical: energy a decentralized oracle community that feeds real-world information into blockchains. These efforts matter for tasks that want worth feeds, random numbers or cross-chain messages.

Associated Studying

If an enormous DeFi protocol adopts CCIP or a serious hack bounty will get paid out, LINK may see recent demand. Till then, the token might drift. Watch the worth close to $11 and $20.

Featured picture from Unsplash, chart from TradingView