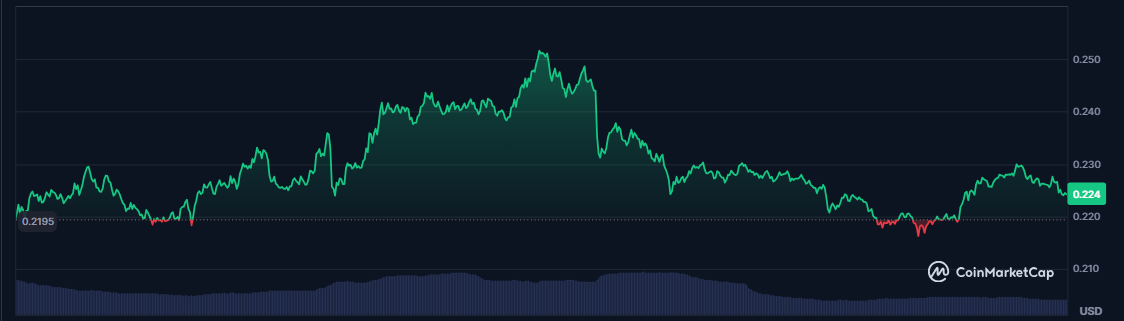

Dogecoin has held regular above $0.22 since Might 20 and climbed again after a short dip. It hit $0.25 on Might 23, then eased into the weekend. Within the final 24 hours, the token is up 4.1%. Over every week, it’s up 5%, despite the fact that it slipped midweek.

The Triangle Sample

In response to TradingView analyst Akbar Karimzsfeh, Dogecoin has been tracing a protracted, tightening triangle since its all-time excessive of $0.73536 on Might 3, 2021. That peak was adopted by a drop to $0.048 on June 13, 2022. Since then, each try to interrupt decrease—on June 5, August 14 and October 9 of 2023—has failed. The strains of the triangle are closing in. Once they meet, a pointy transfer is probably going.

Key Resistance Ranges

Based mostly on data, the higher trendline of the triangle additionally matches the highest of a giant “cup” sample round $0.4916. There was an tried breakout in December 2024, and costs virtually hit that $0.4916 mark however bought pushed again. After that, DOGE slid right down to $0.13. It has since recovered some floor, nevertheless it nonetheless has to clear that $0.4916 hurdle earlier than bulls can declare actual management.

Current Worth Strikes

Dogecoin hovered round $0.22 between Might 20 and Might 26. It peaked at $0.25 on Might 23, solely to slide afterward. Then the final 24-hour achieve of 4.1% confirmed it could actually bounce from assist. The 5% weekly rise factors to regular shopping for, even with some pullbacks in the course of the week. Merchants are expecting a day by day shut above $0.50 as an indication that the lengthy squeeze is over.

On-Chain Metrics Rise

On-chain information backs up the worth motion. New addresses have jumped by 102.40% previously seven days. Lively addresses climbed 111.32%. Zero steadiness addresses went up 155.45%. That means extra individuals are sending small quantities of DOGE or testing the community. It doesn’t assure they’re holding long run, nevertheless it does flag increased curiosity and exercise.

If Dogecoin can break above the highest trendline and maintain above $0.49, some see a transfer towards $3.08. That concentrate on is predicated on including the triangle’s peak to the breakout level. It’s an enormous leap. Psychology and buying and selling charges may gradual that run. However the sample says a powerful transfer could also be coming.

Based mostly on studies, warning remains to be clever. Look ahead to clear affirmation earlier than betting on a moonshot. A slip under the decrease trendline close to $0.05 would flip the image bearish. For now, Dogecoin sits within the steadiness, squeezed between two key trendlines. Merchants and followers might be watching each shut above $0.49 or fall under $0.05 to gauge the following large transfer.

Featured picture from Gemini Imagen, chart from TradingView