Crypto markets transfer quick. Costs can sit nonetheless for days, then explode in minutes. These sharp strikes are known as breakouts, and recognizing them early is without doubt one of the most dear expertise a crypto dealer can study.

The excellent news is that you just don’t want superior math or advanced buying and selling techniques. With the precise crypto breakout indicators, even newbies can study to acknowledge when an enormous transfer could be coming.

On this information, you’ll study what a crypto breakout is, spot one, which technical indicators work finest, and mix them into easy, efficient methods.

What Is a Crypto Breakout?

A crypto breakout is a market scenario when the value of an asset strikes outdoors the vary widespread for it.

The 2 most vital phrases that you must know are those between which this vary types—support and resistance levels.

- Assist: a value stage the place demand exceeds provide (shopping for stress), which stops the value from falling additional.

- Resistance: a value stage the place provide exceeds demand (promoting stress), which prevents the value from rising.

When value breaks above resistance, it’s known as a bullish breakout.

When value breaks under assist, that’s a bearish breakout.

Breakouts are vital as a result of they usually mark the beginning of a brand new pattern. As a substitute of sluggish, sideways motion, the market out of the blue good points momentum. Merchants search for breakouts to enter positions early, earlier than the most important a part of the transfer occurs.

In crypto, breakouts are particularly widespread as a result of excessive volatility, steady buying and selling, and quick, robust emotional reactions from retail merchants.

Study extra about bullish and bearish market cycles.

The right way to Spot a Potential Breakout

Earlier than utilizing indicators, it helps to grasp value construction. Breakouts don’t occur randomly. They often observe clear visible clues on the chart.

The right way to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero value

Assist and Resistance Ranges Defined

Assist and resistance are the inspiration of breakout buying and selling. Assist is a value zone the place consumers step in. Its reverse is resistance, a value zone the place sellers take management. These ranges type as a result of merchants maintain observe of costs. If Bitcoin has failed at $40,000 a number of instances earlier than, many merchants will anticipate resistance there once more.

A breakout turns into extra probably when:

- Value assessments the identical stage a number of instances.

- The vary will get tighter.

- Patrons or sellers grow to be extra aggressive.

The extra instances a stage is examined, the extra significant a breakout turns into when it lastly occurs.

Chart Patterns That Sign Breakouts (Triangles, Flags, Rectangles)

The value historical past of each cryptocurrency is accessible publicly. And there are particular chart patterns which are recognized to sign upcoming breakouts.

You possibly can learn to learn cryptocurrency charts in our dedicated article.

Triangles

A triangle sample is a chart form that types when value strikes right into a tightening vary. It exhibits consumers and sellers reaching a steadiness earlier than an enormous transfer. Triangles usually seem earlier than breakouts and might sign pattern continuation or reversal, relying on the path of the breakout. There are three essential kinds of triangle patterns.

- Ascending triangle (a flat high with rising lows) often alerts a bullish breakout as consumers push costs greater.

- Descending triangle (a flat backside with falling highs) usually factors to a bearish breakout as promoting stress will increase.

- Symmetrical triangle (when each highs and lows converge) exhibits market indecision and might escape in both path, usually following the earlier pattern.

Typical indicators of a triangle sample embrace value making greater lows and decrease highs, in addition to volatility shrinking over time. A breakout often occurs close to the top of the triangle.

Flags

A flag sample is a chart form that seems after a powerful value transfer, adopted by a brief pause earlier than the pattern continues. It exhibits the market taking a quick break whereas consumers or sellers regroup. Flags are often an indication of pattern continuation, not reversal, and will be bullish or bearish relying on the path of the preliminary transfer.

- A bullish flag types after a pointy upward transfer, with value drifting barely downward or sideways in a good channel earlier than breaking greater.

- A bearish flag seems after a powerful drop, adopted by a small upward or sideways consolidation earlier than value continues decrease.

Flag patterns usually appear like small rectangles or channels. Quantity is often excessive in the course of the first transfer and decrease throughout consolidation, then will increase once more on the breakout.

Rectangles

A rectangle sample is a chart form that types when value strikes sideways between clear horizontal assist and resistance ranges. It exhibits a pause out there, the place consumers and sellers are evenly matched and no clear pattern is in management. Rectangles usually seem during times of consolidation and often finish with a breakout.

- The high of the rectangle acts as resistance, the place promoting stress stops value from shifting greater.

- The backside of the rectangle acts as assist, the place shopping for curiosity prevents additional declines.

Value strikes backwards and forwards inside this “field” till momentum builds. The sample is full when value breaks above resistance or under assist, usually beginning a brand new pattern. Some merchants commerce contained in the vary, whereas others watch for the breakout for affirmation.

Breakout Quantity

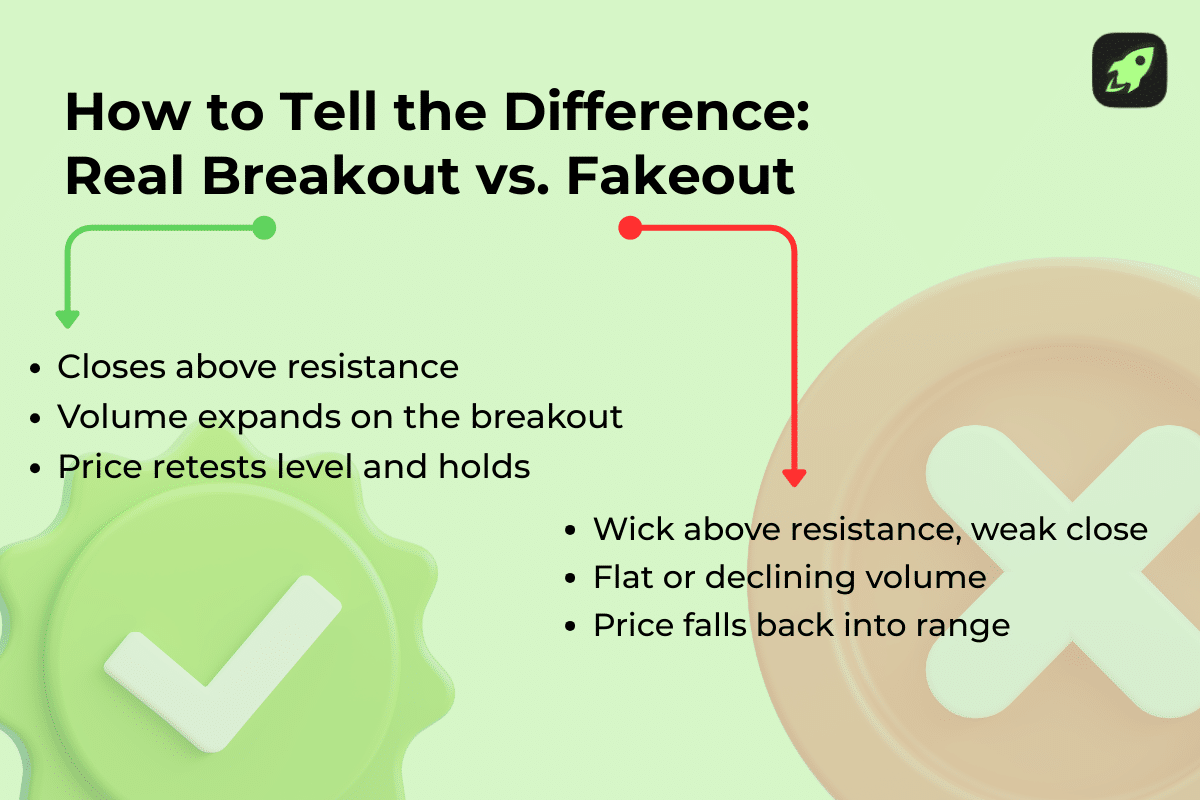

The breakout quantity is the quantity of buying and selling exercise that occurs when value breaks above resistance or under assist. Quantity is without doubt one of the most vital breakout confirmations. It’s simple to evaluate, since a real breakout often comes with each rising quantity and robust participation from merchants, whereas low-volume breakouts usually fail as they lack conviction. If value breaks resistance however quantity stays flat, it usually factors to a false breakout—one which results in the value shifting again to its earlier vary. All the time test quantity earlier than trusting the transfer.

Finest Technical Indicators for Crypto Breakouts

Now it’s time to try probably the most dependable technical indicators of a crypto breakout. These instruments assist verify what value motion is already suggesting.

1. Shifting Averages

Shifting averages easy out value knowledge and present the general pattern. They assist you perceive whether or not the market is mostly shifting up, down, or sideways.

Frequent sorts:

- Easy Shifting Common (SMA)

An SMA calculates the typical value over a set variety of durations. Each value is given equal weight, so it reacts extra slowly to sudden value modifications. It’s helpful for recognizing long-term developments. - Exponential Shifting Common (EMA)

An EMA additionally averages costs, nevertheless it provides extra weight to current knowledge. This makes it react quicker to cost modifications, which is useful for figuring out short-term developments and potential breakouts.

EMAs are measured in models of time (durations of 9, 12, 20, 26, 50, 100, and 200—days, hours, or minutes). A quicker EMA reacts shortly to cost modifications as a result of it makes use of a shorter time interval. Examples embrace the 9 EMA or 20 EMA. A slower EMA strikes extra easily as a result of it makes use of an extended timeframe. It reacts extra slowly to cost modifications and helps present the general pattern. Frequent examples are the 50 EMA and 200 EMA.

How they assist with breakouts:

- When value strikes above an vital shifting common, it could possibly sign that consumers are taking management.

- When a quicker EMA crosses above a slower EMA, it usually hints {that a} breakout could also be coming.

- Shifting averages can act like shifting assist or resistance ranges the place value usually reacts.

- Generally used ranges embrace the 20 EMA, 50 EMA, and 200 EMA, which many merchants watch intently.

2. Bollinger Bands

Bollinger Bands are a well-liked technical indicator that helps merchants measure market volatility, which merely means how a lot the value is shifting up and down. When the market is calm, volatility is low. When value begins shifting quick, volatility is excessive.

Bollinger Bands are made up of three traces:

- The center line, which is a shifting common. A shifting common smooths value knowledge to point out the overall path of the pattern.

- The higher band, which sits above the typical and exhibits when value is comparatively excessive.

- The decrease band, which sits under the typical and exhibits when value is comparatively low.

When the bands tighten, it means value motion has slowed and volatility is low. This part known as a Bollinger Band squeeze. Squeezes usually occur earlier than a breakout, when value out of the blue begins shifting strongly in a single path.

Frequent breakout alerts embrace value closing outdoors the bands, bands increasing after being tight, and better buying and selling quantity, which confirms that many merchants are taking part. Bollinger Band squeezes are particularly helpful in crypto, the place sharp value strikes occur usually.

Learn extra: Bollinger Bands and How to Use Them in Crypto Trading

3. Relative Energy Index (RSI)

The Relative Energy Index (RSI) is a well-liked indicator that helps merchants perceive momentum, or how robust a value transfer is. It really works on a scale from 0 to 100, making it simple to learn even for newbies.

Historically, RSI is interpreted like this:

- Above 70 means the asset could also be overbought, which implies value has gone up very quick and will decelerate or pull again.

- Under 30 means the asset could also be oversold, which implies value has dropped shortly and will bounce upward.

When buying and selling breakouts, RSI is utilized in a barely totally different approach. As a substitute of in search of overbought or oversold ranges, merchants concentrate on momentum power.

Key breakout-focused RSI alerts embrace:

- RSI breaking above 50, which frequently exhibits bullish momentum is constructing.

- RSI holding above 40 throughout consolidation, which means consumers are staying in management even whereas value strikes sideways.

- RSI divergence, which occurs when RSI strikes in a unique path than value and might sign a breakout is coming.

General, RSI helps verify whether or not a breakout has actual momentum behind it. Study extra about RSI in our dedicated guide.

4. MACD (Shifting Common Convergence Divergence)

MACD, brief for Shifting Common Convergence Divergence, is an indicator that helps merchants see each momentum (i.e. how robust a transfer is) and pattern path (whether or not value is shifting up or down). It’s constructed from shifting averages, which implies it reacts to modifications in value over time.

MACD has three essential elements:

- The MACD line, the primary line that exhibits modifications in momentum.

- The sign line, a smoother line that helps spot pattern shifts.

- The histogram, bars that present the gap between the MACD line and the sign line, making momentum simpler to see.

For breakouts, merchants search for just a few key alerts:

- A bullish MACD crossover, when the MACD line crosses above the sign line close to resistance, suggesting upward momentum.

- The histogram increasing after consolidation, which exhibits momentum growing after a quiet interval.

- MACD crossing above the zero line, which means the pattern is shifting from bearish to bullish.

MACD works finest when mixed with value construction, corresponding to assist, resistance, or chart patterns, to verify actual breakouts.

Study extra: How to Use MACD in Crypto Trading

5. Quantity Indicators

Quantity indicators assist merchants perceive how robust a value transfer actually is by wanting past value alone. Whereas primary quantity exhibits how a lot of an asset is traded, quantity indicators add additional context and make developments simpler to identify.

Two in style quantity indicators are:

- On-Stability Quantity (OBV), a operating complete that provides quantity on up days and subtracts it on down days. It helps present whether or not consumers or sellers are in management.

- Quantity Shifting Averages, which easy out quantity knowledge over time, making it simpler to see when buying and selling exercise is unusually excessive or low.

For breakout buying and selling, look ahead to these alerts:

- OBV rising whereas value strikes sideways, which suggests quiet shopping for, additionally known as accumulation.

- Quantity growing earlier than resistance breaks, exhibiting rising curiosity earlier than an enormous transfer.

- Quantity spikes on the breakout, confirming that many merchants assist the transfer.

Quantity indicators usually reveal hidden accumulation earlier than value strikes.

6. Stochastic Oscillator and StochRSI

These indicators concentrate on momentum, which implies how briskly and the way robust the value is shifting. Additionally they assist establish overbought and oversold circumstances and examine the present value to its current vary to point out when momentum is constructing or fading.

They’re helpful for:

- Timing breakout entries, serving to you enter nearer to the beginning of a transfer.

- Recognizing momentum shifts throughout consolidation, when value strikes sideways.

Breakout-friendly alerts embrace:

- Stochastic crossing upward from low ranges, suggesting consumers are stepping in.

- StochRSI breaking above 0.5, exhibiting momentum turning bullish.

- Momentum growing earlier than value escapes the vary, usually a breakout warning.

These indicators work finest when mixed with pattern indicators like shifting averages.

Prime 3 Breakout Indicator Combos for Crypto

Single indicators will be deceptive. Combining instruments reduces false alerts and improves accuracy. Listed here are three helpful breakout indicator mixtures.

Instance 1: EMA + RSI + Quantity

- EMA exhibits pattern path.

- RSI confirms momentum.

- Quantity confirms participation.

Bullish Setup

- Value above key EMA.

- RSI above 50 and rising.

- Quantity will increase on resistance break.

This combo is easy, clear, and efficient for trending markets.

Instance 2: Bollinger Bands + MACD

- Bollinger Bands establish volatility squeezes.

- MACD confirms momentum shifts.

Bullish Setup

- Bands tighten considerably.

- MACD bullish crossover.

- Value closes above higher band.

This technique is right for recognizing explosive strikes after quiet durations.

Instance 3: Triangle Sample + OBV

- Triangle sample defines construction.

- OBV reveals accumulation or distribution.

Bullish Setup

- Ascending or symmetrical triangle.

- OBV rising earlier than breakout.

- Value breaks resistance with quantity.

This combo helps keep away from pretend breakouts and improves confidence.

Closing Ideas

Crypto breakouts provide a few of the finest buying and selling alternatives—however provided that you understand how to identify them. A very powerful lesson is that this: breakouts are about affirmation, not prediction. Value motion comes first. Indicators assist verify what the market is already exhibiting.

Begin easy by studying assist and resistance, watching quantity, and utilizing 2–3 indicators you perceive effectively. Over time, you’ll acknowledge breakout setups quicker and keep away from widespread errors like chasing false strikes.

FAQ

Can I take advantage of breakout indicators on smaller altcoins or are they higher for Bitcoin and Ethereum?

You should use breakout indicators on altcoins too, however watch out. Smaller altcoins are extra unstable and simpler to govern, which implies extra false breakouts. Breakout methods work finest on cash with good liquidity and buying and selling quantity, like Bitcoin, Ethereum, and large-cap altcoins.

What’s a superb win charge or success charge for breakout methods in crypto?

A sensible win charge is often 40–60%. Breakout buying and selling focuses extra on danger–reward than being proper each time. A number of robust successful trades can outweigh a number of small losses.

Do breakout methods nonetheless work in bear markets, or are they principally for bull runs?

They work in each, however otherwise. In bull markets, upside breakouts are extra widespread. In bear markets, draw back breakouts (breakdowns) occur extra usually. You need to commerce within the path of the general pattern.

Ought to I at all times use stop-losses with breakout trades?

Sure. All the time use a stop-loss. Breakouts fail usually, and a stop-loss protects your capital. It turns a foul commerce right into a stumble quite than a fall.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.